If you've ever wondered how the value of gold and silver is determined, you've come to the right place. The whole process starts with a single, crucial number: the spot price.

Think of the spot price as the live, real-time cost for one troy ounce of pure gold or silver, ready for immediate delivery. It’s the universal benchmark that sets the stage for every transaction involving precious metals across the globe. From massive trades on international exchanges down to the gold necklace you’re thinking of selling, it all begins here. This is a foundational concept for anyone interested in Gold and Jewelry Buying.

What Is the Spot Price and Why Does It Matter?

Imagine the spot price is like the wholesale cost of flour for a baker. Before a bakery can price a loaf of bread, they first need to know the current cost of their main ingredient. The spot price works the same way for your jewelry—it’s the foundational value of the raw metal.

This fluctuating number is the bedrock upon which all fair offers are built, giving everyone a transparent and universally understood starting point.

For anyone looking into gold and jewelry buying, getting familiar with the spot price is non-negotiable. It’s your key to knowing whether you’re getting a fair shake. When you decide to sell your pieces, this number directly shapes the payout you’ll walk away with. The connection is simple: the spot price for gold and silver sets the baseline value for your rings, bracelets, coins, and heirlooms.

The Foundation of a Fair Offer

That global benchmark is exactly what we use here at Carat 24 to make sure you get the highest payout in Boise. We don't pull numbers out of thin air or guess what your jewelry might be worth. Instead, our offers are calculated based on three straightforward, transparent factors:

- The Live Spot Price: We check the up-to-the-minute market value of pure gold or silver.

- Purity (Karat): We determine the exact percentage of pure metal in your item.

- Weight: We measure the total mass of your piece with precision.

Our entire process is designed to be completely open and honest. We even offer free Xray Scanning and Gold Testing to confirm the purity of your items right in front of you. That way, you see the exact data we’re using to build our hassle-free offer. No mystery, no confusing jargon—just simple math based on real-time market data. Our goal is to empower you with the right information so you can feel completely confident in your decision.

Market Volatility and Your Payout

The spot price is never static; it's always on the move, reacting to global economic news, market sentiment, and geopolitical events. For example, by September 12, 2025, the spot price for gold had surged to around $3,650 per troy ounce, a major jump of 41.53% from the previous year. This spike was driven by things like expectations of looser U.S. monetary policy and international tensions.

This constant movement is a big reason why selling locally makes so much sense. When you work with us, you can lock in a price based on what the market is doing right now. You save the hassle and sell locally for more than online shipments, completely avoiding the risks of shipping delays, lost packages, and prices that could drop while your items are in transit.

We even offer Price Matching to guarantee our offer is the best you'll find anywhere. For more tips on getting the most value for your items, feel free to check out some of our other helpful articles on our blog.

To make it even clearer, here's a quick rundown of what the spot price really means for you.

Spot Price Key Concepts at a Glance

| Concept | What It Means for You |

|---|---|

| Live Market Price | This is the current, real-time value of raw gold or silver. We use this number as the starting point for your offer. |

| Purity (Karat) | The spot price is for pure (24k) gold. We adjust the offer based on your item’s specific purity (e.g., 14k, 18k). |

| Weight | The heavier your item, the more raw metal it contains, which directly increases its base value. |

| Premium/Markup | Retail jewelry is sold above spot price. When you sell, the offer will be below spot to cover refining costs. |

| Volatility | The price changes constantly. Selling locally allows you to lock in a favorable price instantly. |

Ultimately, understanding the spot price empowers you to make smarter decisions, ensuring you get a transparent and fair deal every time.

The Hidden Forces Driving Gold and Silver Prices

The spot price for gold silver you see on the news isn't just some random number pulled out of thin air. Think of it more like a sensitive barometer, constantly measuring the health and mood of the global economy. It’s the result of a massive, ongoing tug-of-war between powerful economic forces.

When things get shaky—a stock market dip, political instability, you name it—investors tend to flock to the perceived safety of gold, driving its price up. This is exactly why you'll hear gold called a "safe-haven" asset. It has a reputation for holding its ground when other investments start to wobble, making it a timeless store of wealth.

Key Drivers Behind Market Movements

So, what are these big forces pushing and pulling on the price? Several key factors are always in play, creating the daily fluctuations you see. Getting a feel for these can help you better time your gold and jewelry buying or selling.

- Interest Rates and Central Bank Policy: Keep an eye on what the U.S. Federal Reserve is doing. When central banks lower interest rates, it can make the dollar weaker. A weaker dollar often means gold becomes cheaper for buyers using other currencies, which can boost demand and nudge the spot price higher.

- Inflation Fears: Gold has been a go-to hedge against inflation for centuries. When the cost of living climbs and your cash doesn't stretch as far, the solid, intrinsic value of gold starts looking very attractive. This often leads to a surge in its price.

- U.S. Dollar Strength: Gold and the U.S. dollar generally have an inverse relationship. Because gold is priced in dollars around the world, a stronger dollar makes gold more expensive for foreign investors, which can cool demand and lower the price. On the flip side, a weaker dollar can give gold’s value a lift.

For anyone looking to get the highest payout in Boise, paying attention to these global trends is a smart move. Selling your gold during a period of high inflation or when interest rate cuts are on the horizon could mean a much better return. It’s all about reading the global cues.

Silver's Unique Industrial Role

Silver often moves in step with gold as a safe-haven asset, but it has a whole other side to its story: industrial demand. Gold is primarily held for investment, but silver is a workhorse. It’s a crucial component in everything from solar panels and electric vehicles to the smartphone in your pocket.

This dual role means silver's price is a mix of investment trends and industrial production cycles. A massive boom in green technology, for instance, could send demand for silver soaring, pushing its price up completely independently of what gold is doing. This industrial connection is a big reason why silver prices can sometimes be more volatile.

For a deeper dive into the specifics of these metals, our guide on coins and bullion information offers more detailed insights.

Key Takeaway: The spot price is a living number, shaped by global economics, central bank decisions, and real-world demand. Gold is mostly an investment haven, while silver’s value is also deeply connected to its essential role in modern industry.

Once you understand these forces, you're empowered. You no longer just see a price; you see a story unfolding about the global economy. This knowledge is your best tool when you decide it's time to sell, helping you feel confident in your decision.

It also helps you save the hassle and sell locally for more than online shipments, because you can act on favorable market conditions right away. We make that next step easy with hassle-free offers, a solid Price Matching promise, and total transparency using free Xray Scanning and Gold Testing.

How to Read Live Precious Metal Price Charts

Live price charts can look intimidating at first glance, but they’re really just telling a story about the spot price for gold silver over time. Think of it like a weather map for precious metals. Instead of showing temperature and pressure, it shows price and time, giving you a clear picture of what the market is doing.

Learning to read these charts puts you in the driver's seat. It lets you check the market for yourself before you sell, so you can walk in with a solid understanding of the value behind any offer you receive. This knowledge is especially powerful for gold and jewelry buying, helping you recognize a great moment to make a move.

Demystifying Key Chart Terms

When you pull up a live price chart, you’ll see a few key numbers that are crucial for understanding the market at that exact moment. Get a handle on these three terms, and any chart will instantly make more sense.

- Bid Price: This is the price dealers are willing to pay to buy gold or silver from you. If you’re selling, this is the number that matters most.

- Ask Price: This is what dealers are asking you to pay to buy metals from them. It's always just a bit higher than the bid price.

- Spread: This is simply the small difference between the bid and ask prices. It represents the dealer’s margin for making the transaction happen.

Understanding this trio gives you a real-time snapshot of market dynamics. When you decide it’s time to get the highest payout in Boise, knowing the current bid price helps you set realistic expectations for your sale.

Reading Trends and Volatility

Beyond the live numbers, these charts tell a powerful story about the past. You can usually adjust the timeline to see everything from a single day's activity to several years of history, which reveals the long-term trends. Seeing how the market has moved over time helps you understand its volatility and make much more informed decisions.

Historically, the spot price of gold has fluctuated quite a bit, often mirroring major economic events and global issues. Looking back at the data, gold has had positive annual returns in about 59% of the years between 1979 and 2024, which is right in line with its reputation as a reliable store of value. You can dig deeper into historical gold prices over at the World Gold Council's data hub.

At Carat 24, we believe an informed customer is an empowered one. That’s why we offer free Xray Scanning and Gold Testing, providing full transparency so our hassle-free offers are always easy to understand. We honor a Price Match guarantee, ensuring you always get the best value.

By learning to read these charts, you can save the hassle and sell locally for more than online shipments. You’ll be able to spot favorable market conditions and act with confidence, securing a great price without the risks that come with mail-in services. For the very latest market movements, you can always check out our precious metals price updates right here on our site.

From Spot Price to Your Highest Payout

The global spot price for gold silver is the starting line, but how do we get from that number to the actual cash in your hand? This is where the true value of your items is determined, connecting the live market price to the unique characteristics of your personal jewelry. This is the core of professional Gold and Jewelry Buying.

The most important factor is purity. A 14k gold ring simply isn't valued the same as a pure 24k gold bar because it contains less pure gold. The "karat" system is a measure of this purity, and it’s the key to figuring out your payout.

The Simple Math of Your Gold's Value

The process of valuing your gold jewelry is transparent and surprisingly straightforward. It's not about guesswork; it's about simple math based on three key elements:

- Current Spot Price: The live price for one troy ounce of pure (24k) gold.

- Purity (Karat): The percentage of pure gold in your item. For example, 14k gold is 58.3% pure gold.

- Weight: The total weight of your item, measured accurately.

By multiplying these factors, a professional buyer can determine the exact value of the precious metal your jewelry contains. This clear-cut calculation forms the basis of any fair and honest offer. This same principle applies to everything from rings to more unique items, which you can learn more about in our article on how much is a gold tooth worth.

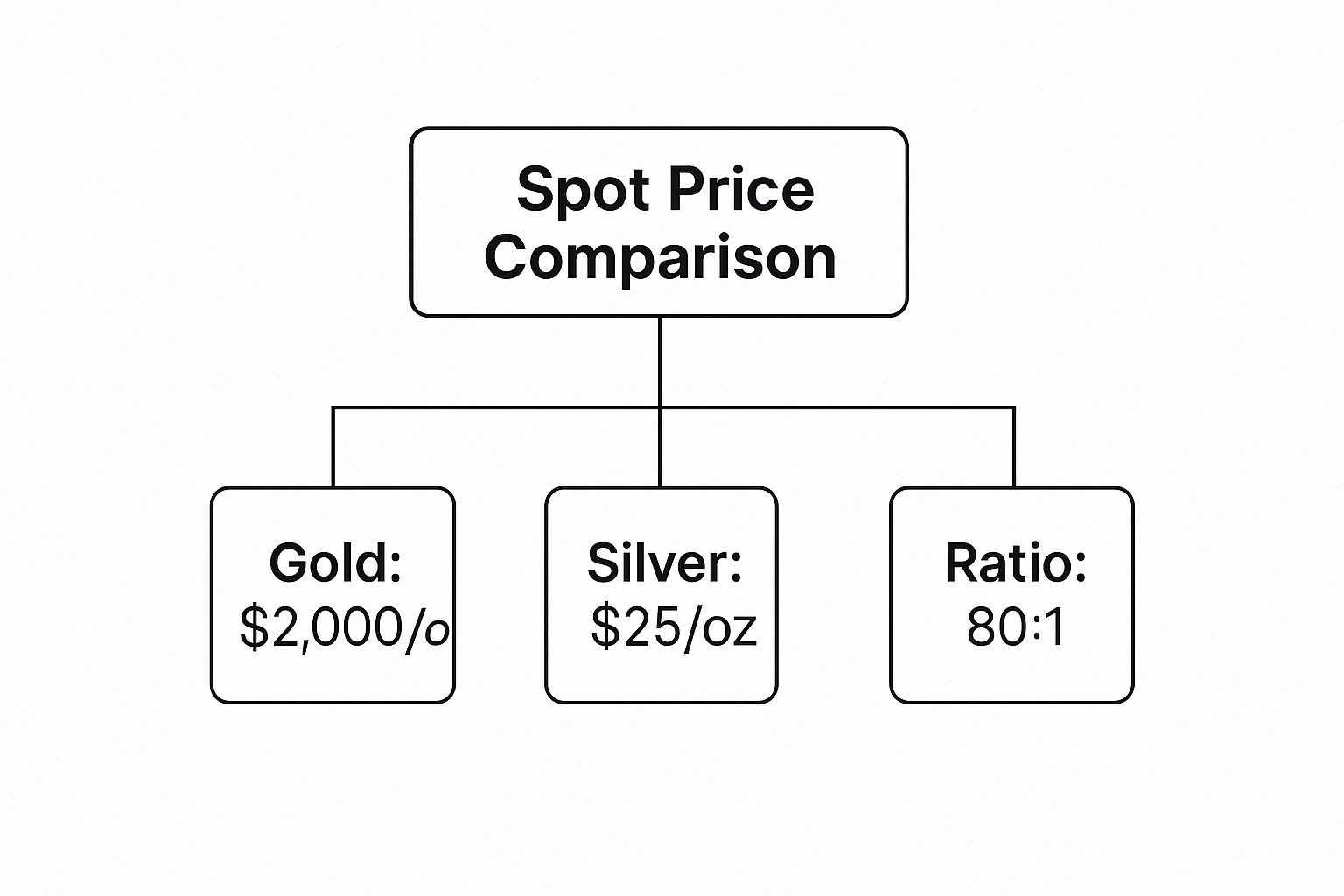

The image below gives you a quick snapshot comparing gold and silver spot prices, highlighting the significant difference in value.

This visual clearly illustrates the gold-to-silver ratio, a key metric investors watch to gauge the relative value between the two precious metals.

Gold Karat and Purity Conversion

Understand your jewelry's actual gold content with this simple conversion guide.

| Karat (K) | Purity (% Gold) | Common Use |

|---|---|---|

| 24K | 99.9% | Pure gold bullion, coins |

| 22K | 91.7% | High-end jewelry, some coins |

| 18K | 75.0% | Fine jewelry, watches |

| 14K | 58.3% | Standard for U.S. jewelry |

| 10K | 41.7% | Durable, affordable jewelry |

This table helps translate the stamp on your jewelry into its real gold content, which is the first step in understanding its true worth.

Transparency You Can See and Trust

Knowing the theory is one thing, but seeing it in action provides true confidence. This is why we've invested in providing a completely transparent gold and jewelry buying experience. We don't just tell you what your items are worth—we show you.

At Carat 24, we offer complimentary, state-of-the-art Xray Scanning and Gold Testing services. This technology gives us a precise, verifiable reading of your item's purity right in front of you, eliminating all doubt and forming the foundation for our hassle-free offers.

This commitment to clarity ensures you get the highest payout in Boise. You'll see the exact data we use, understand how your offer is calculated, and feel confident in your decision. We also stand by our Price Matching guarantee, so you know you’re getting the best possible value.

Ultimately, you can save the hassle and sell locally for more than online shipments. Avoid the uncertainty of mail-in services and enjoy a secure, immediate transaction with experts who prioritize your trust and satisfaction above all else.

Why Selling Locally in Boise Beats Online Mailers

When it’s time to sell your valuables, those online mail-in services can look pretty tempting. They send you a prepaid envelope, you ship your items off, and you wait for an offer. Simple, right? But that convenience often comes with a hidden cost—and I’m not just talking about money. It’s a process filled with risks, delays, and a total lack of transparency that can leave you with a lighter wallet and a lot more anxiety.

Think about it from a real-world perspective. Let’s imagine Sarah, a local Boise resident, who just inherited her grandmother's old gold jewelry. She wasn't sure what it was worth and saw an ad for a mail-in company. But the idea of sending irreplaceable family heirlooms into a shipping void, with zero control over what happens next, just didn't sit right. What if the package gets lost? How could she ever know if the offer was fair, or just a quick lowball number they hoped she'd accept?

The Power of a Face-to-Face Transaction

Sarah decided to trust her gut and went a different route. She visited a local expert for a secure, in-person evaluation, and her experience highlights the huge advantages of working with a trusted buyer right here in your community, especially for something as personal as gold and jewelry buying.

- Immediate Service: Forget waiting around for shipping kits or return packages. You get real answers and a solid offer on the spot.

- Total Transparency: You’re part of the process. You watch everything from the weighing to the testing, and you can ask all the questions you want.

- Instant Payment: When you agree on a price, you walk out with payment in hand. No waiting for a check to hopefully show up in the mail or for a bank transfer to clear.

Here at Carat 24, we cut out all that uncertainty. We offer free Xray Scanning and Gold Testing right in front of you, so you can see the exact purity and weight of your items for yourself. This transparent, open process is the bedrock of our hassle-free offers, which are always based on the live spot price for gold and silver.

When you sell locally, you trade uncertainty for confidence. That peace of mind from a direct, transparent transaction is invaluable—you'll never have to wonder if you got the best possible price for your items.

Get the Highest Payout in Boise, Guaranteed

At the end of the day, you want to get the most value for your jewelry. That’s the whole point. Many online services build their entire business model on making low offers, banking on the fact that most people won't want to deal with the hassle of having their items shipped back. We do the exact opposite. Our reputation in Boise is built on trust and giving people the highest payout in Boise.

We’re so confident in our pricing that we back it up with a Price Matching guarantee. If you bring us a better written offer from another local competitor, we'll match it. You can save the hassle and sell locally for more than online shipments. Avoid the risks, skip the waiting game, and get the maximum value for your precious metals with a team you can actually meet and trust.

Your Gold and Silver Questions Answered

https://www.youtube.com/embed/KUGekw_kQBo

Diving into the world of gold and jewelry buying can definitely spark a lot of questions. As you start connecting the dots between what’s happening in the global markets and the value of the items you hold in your hand, it's only natural to want some straight answers.

We get it. That’s why we’ve put together some of the most common questions we hear from our customers right here in Boise. Our goal is to make everything crystal clear, so you feel confident and in control when you decide it’s time to sell your precious metals.

Is the Spot Price My Exact Payout?

That’s an excellent question and probably the most common one we hear. The short answer is no. Think of the spot price for gold silver as the starting line—it’s the live price for pure, 24k metal. Your actual payout is calculated from that price but is then adjusted based on your item's specific purity (its karat) and its total weight.

Here at Carat 24, we take all the guesswork out of the equation. We use our free, state-of-the-art Xray Scanning and Gold Testing to find out the exact purity of your items, and we do it right in front of you. This process ensures your hassle-free offer is completely transparent and based on the true amount of precious metal your jewelry contains. You can also learn more from our detailed guide on how to identify fake gold to better protect yourself.

Why Is Silver So Much Cheaper Than Gold?

It really just boils down to two things: rarity and demand. Gold is simply much, much harder to find in the earth's crust than silver, which automatically makes it more valuable. It’s like the difference between diamonds and quartz—both are minerals, but one is exceptionally rare, and its price reflects that.

There's another piece to the puzzle, too. While gold is seen mainly as an investment and a metal for jewelry, silver has a huge range of industrial uses. This means its price is tied more closely to the ups and downs of economic activity and manufacturing. Gold's primary role as a premium store of value keeps its price on a much higher playing field.

How Often Does the Spot Price Change?

The spot price is constantly on the move. It literally updates every few seconds as long as global markets are open, reflecting live trading from exchanges all over the world. This is a huge reason why you should save the hassle and sell locally for more than online shipments.

An offer you get from an online buyer might be based on yesterday's price. Even worse, the price could drop significantly while your items are in the mail. When you sell to us, we use up-to-the-minute pricing to lock in your offer, guaranteeing you get a fair payout based on the market's value at that very moment.

What if Another Boise Store Offers More?

We are serious about giving you the highest payout in Boise, and that’s a promise we stand by. If you walk in with a legitimate, written offer from another local competitor, we will gladly honor our Price Matching guarantee.

Our entire mission is to provide every single customer with a top-dollar offer and a positive, straightforward experience. You should be able to sell your valuables with total confidence, knowing you received the best possible price without any games or pressure.