Ever wonder why the price of gold seems to have a mind of its own? It’s not random. The value of that gold ring or coin isn’t just pulled out of thin air; it’s a direct reflection of a complex global dance between big-picture economics, investor moods, and the simple push-and-pull of supply and demand.

The Real Forces Driving the Price of Gold

Think of gold less like a simple chunk of metal and more like a sensitive financial barometer. It reacts in real-time to the health of the global economy, the decisions made by central banks, and the gut feelings of investors everywhere. Getting a handle on what makes gold prices tick is the first step toward making a smart move, whether you're looking to buy, hold, or sell.

If you're thinking about Gold and Jewelry Buying, understanding these factors is your key to timing a sale perfectly and getting the highest payout in Boise. This guide will walk you through each major driver, connecting those big headlines about the economy to the real-world value of the gold you own. To get a better feel for the daily market shifts, you can dive into our article on the spot price for gold & silver.

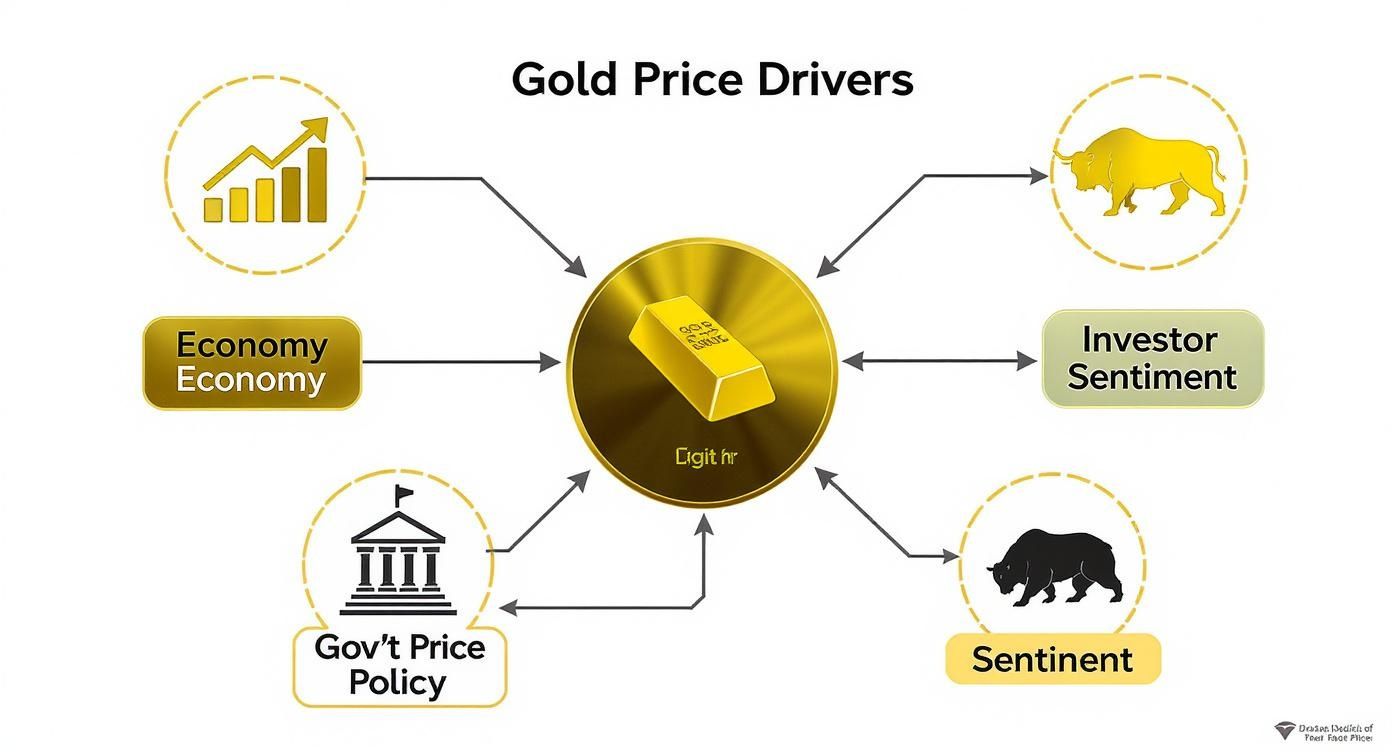

Key Drivers At a Glance

This map breaks down how huge forces like the economy, government action, and overall market sentiment all tie together to influence gold’s bottom-line value.

As you can see, no single factor operates on an island. They all work together, creating a dynamic system that’s constantly nudging the price up or down.

Figuring out the best time to sell your gold shouldn't be a headache. You can skip the hassle of shipping your items to an online buyer and sell locally—often for more money. We provide free Xray Scanning and Gold Testing to give you a transparent, hassle-free offer right on the spot. We even offer Price Matching to make sure you walk away with the best possible value for your gold.

To make things even clearer, here's a quick cheat sheet of the primary forces we’ll be exploring.

Quick Guide to Gold Price Drivers

This table gives you a snapshot of the main factors that move the needle on gold prices and what they mean for you as a buyer or seller.

| Factor | How It Typically Affects Gold Price | Why It Matters to You |

|---|---|---|

| Inflation & Deflation | Rises with inflation; investors buy it to protect their money's value. | High inflation? Your gold is likely worth more. |

| Interest Rates | Price tends to fall when rates rise (other investments become more attractive). | When the Fed raises rates, gold prices might dip. |

| The U.S. Dollar | Moves opposite to the dollar. A weaker dollar usually means higher gold prices. | A falling dollar can be a great time to sell your gold. |

| Geopolitical Turmoil | Price increases during global uncertainty as people seek a "safe haven." | Global conflicts or instability often boost gold's value. |

| Central Bank Buying | Price rises when central banks buy large amounts to diversify their reserves. | This creates a strong, stable floor for gold prices. |

| Supply & Demand | Price increases with higher demand (jewelry, tech) or lower supply (mining issues). | Consumer trends and mining output directly impact value. |

Understanding these drivers puts you in the driver's seat. It helps you see the bigger picture behind the daily price fluctuations and make decisions with confidence.

How Economic Health Impacts Your Gold's Value

The overall health of the economy is one of the most powerful forces pulling the strings on your gold's value. Think of those big economic reports on inflation or interest rates not as abstract numbers, but as direct signals that can send the price of gold soaring or sinking. Learning to read these signals is the key to making a smart call when it's time for Gold and Jewelry Buying or selling.

When the economy is humming along and consumer confidence is high, investors tend to favor assets like stocks that can grow with the market. But the moment economic uncertainty starts to creep in, gold often steps back into the spotlight.

The Inflation Shield

Inflation is probably the biggest economic factor you need to watch. Imagine inflation as a slow, steady leak in your cash's tires—it gradually reduces the purchasing power of every dollar you have. A dollar today just won't stretch as far tomorrow.

Gold, on the other hand, is a physical asset with a finite supply. It can't be printed out of thin air like money can. This simple fact makes it an incredible hedge against inflation. When people start worrying their cash is losing value, they often flock to gold to protect their wealth. That surge in demand is what drives prices up.

Gold's main job during economic instability is to act as a store of value. When traditional currencies get weaker due to inflation, gold's intrinsic value often gets stronger, preserving wealth that would otherwise be eaten away.

Knowing how to read these trends can make all the difference in understanding what your items might be worth. If you're curious about the specifics, you can dig deeper in our guide on what your gold is worth.

Interest Rates and Opportunity Cost

Interest rates, especially the ones set by the Federal Reserve, create a completely different dynamic. Here’s the thing about gold: it doesn't pay you anything to hold it. No interest, no dividends. It’s what’s known as a non-yielding asset.

So, when interest rates rise, investments like government bonds suddenly look a lot more attractive because they offer a guaranteed return. This increases the opportunity cost of holding gold. Why keep your money in gold that pays nothing when you can earn interest from a bond? This thinking often leads investors to sell their gold, putting downward pressure on its price.

Conversely, when interest rates are low, the opportunity cost of holding gold is tiny. Bonds are paying next to nothing, which makes gold look like a much more appealing safe-haven investment by comparison. This can give its price a serious boost.

Recent Market Reactions

This relationship between the economy and gold isn't just theory—we see it play out in real-time. Just look at recent history: gold reached an all-time high of $4,381.58 per troy ounce in October 2025, as shaky global market dynamics fueled a massive rally.

In just one month, prices jumped by 9.62%, and they skyrocketed an incredible 49.61% compared to the previous year. That’s how quickly gold can react to economic jitters. You can learn more about historical gold price trends on Trading Economics.

Understanding these economic drivers gives you the power to sell at the right moment. To get the highest payout in Boise, save the hassle and sell locally for more than online shipments. We offer free Xray Scanning and Gold Testing for hassle-free offers and will even provide Price Matching to make sure you walk away with the best possible value.

The US Dollar's Powerful Effect on Gold

Picture a seesaw. On one end you have the price of gold, and on the other, the value of the U.S. dollar. Most of the time, when one side goes up, the other comes down. This powerful inverse relationship is one of the most reliable dynamics to watch when figuring out gold's day-to-day price movements.

But why are they so connected? It all comes down to a simple fact: gold is priced in U.S. dollars on the global market. Every single transaction for gold bullion, whether it's happening in London or Tokyo, gets settled in dollars. This global standard has huge consequences for buyers and sellers all over the world.

Why a Strong Dollar Can Weaken Gold

When the U.S. dollar gets stronger against other major currencies like the Euro or the Yen, it suddenly takes more of those currencies to buy a single dollar. Because gold is priced in dollars, it also takes more of their local money to buy an ounce of gold.

For international investors and jewelry buyers, this makes gold more expensive overnight. A jewelry maker in India or a coin collector in Germany might hit the pause button on their purchases, waiting for a better exchange rate. This dip in global demand can put real downward pressure on the spot price of gold.

This dynamic is absolutely crucial to grasp. Gold's price is deeply tied to the currency markets. Historically, when the dollar weakens, foreign buyers get a better deal, which often boosts demand and lifts gold prices. A strong dollar, however, makes gold more expensive for anyone outside the U.S., which can stifle demand and put a cap on price gains. You can discover more about gold's price history on Goldprice.org.

How a Weak Dollar Can Boost Gold

Now, let's look at the other side of the seesaw. When the U.S. dollar weakens, other currencies can suddenly buy more dollars for the same amount of money. This makes any asset priced in dollars—including gold—cheaper for international buyers.

This "discount" effect can spark a wave of demand from outside the United States. As foreign buyers rush to snag gold at a lower effective price, their buying activity can drive the price of gold higher for everyone. It's a key reason why so many experienced gold owners keep a close eye on currency exchange rates.

Of course, international currency rates aren't the only price consideration. If you're curious about price differences closer to home, you can explore whether gold is cheaper in Mexico in our related article.

Key Takeaway: A weak dollar is like a global sale sign on gold, attracting international buyers and driving up demand. A strong dollar does the opposite, making gold more expensive and potentially cooling off the market.

For anyone thinking about Gold and Jewelry Buying or selling, following the dollar's performance gives you a serious strategic edge. When you're ready to make a move, remember to save the hassle and sell locally for more than online shipments. Here in Boise, we provide a hassle-free offer with free Xray Scanning and Gold Testing, and our Price Matching guarantees you get the highest payout possible.

Understanding Central Bank Influence on Gold

While the day-to-day chatter of the market is driven by investors and fleeting trends, one of the most powerful forces shaping the gold price operates on a much grander scale. We're talking about central banks—the massive financial institutions that manage a country's currency and monetary policy. They are true giants in the gold world.

These banks aren't your typical gold buyers. They are some of the largest holders of gold on the planet, treating it as a foundational reserve asset. Their decisions to buy or sell aren't about chasing quick profits; they're calculated moves based on long-term national strategies. And when they act, the entire market feels the ripples.

Why Central Banks Are Buying Gold

If you look at the data from recent years, one trend is impossible to ignore, especially among emerging economies. Central banks have been on a historic buying spree, consistently scooping up huge quantities of gold to bolster their official reserves. Their reasons are strategic, deliberate, and have big implications for the market.

- Diversification from the US Dollar: For decades, the U.S. dollar has been the world's primary reserve currency. Many countries are now actively working to reduce their reliance on it. Gold provides the perfect alternative—a neutral, physical asset that no single government controls.

- Hedge Against Instability: In a world that feels increasingly uncertain with geopolitical tensions and economic wobbles, gold is a financial anchor. It’s a proven store of value that offers stability when currencies or stock markets start to falter.

- Sign of Financial Strength: Holding a mountain of gold sends a powerful message. It signals economic stability and financial independence to the rest of the world, boosting confidence in that nation’s entire financial system.

This global buying trend is a major driver of gold’s underlying strength. The sheer volume of this official demand creates a solid floor under the gold price, providing support even when private investor interest comes and goes. You can dig into the numbers yourself over at the World Gold Council's Goldhub.

The Impact on Your Gold's Value

This steady, large-scale demand from central banks has a powerful stabilizing effect on the market. Unlike the mood swings of private investors, central bank buying is a consistent force. It provides a reliable source of demand that helps prop up gold's value for the long haul.

Think of this institutional demand as a safety net for the gold market. Even when other factors are pushing prices down, knowing that major global players are consistently buying helps prevent a freefall and builds a strong foundation for future growth.

This behind-the-scenes action directly impacts the value of the gold you own. When you're thinking about Gold and Jewelry Buying, understanding that these powerful institutions are also bullish on gold should give you real confidence in its lasting worth.

To get the highest payout in Boise, it pays to work with buyers who understand these global dynamics. We provide free Xray Scanning and Gold Testing, so you get a transparent, hassle-free offer. And with our Price Matching guarantee, you know you're getting the best deal in town. Save the hassle and sell locally for more than online shipments—you’ll get a fair price based on today's market, backed by true expert service.

From Jewelry to Industry: The Role of Supply and Demand

Beyond the complex world of economic indicators and currency markets, the price of gold is also grounded in the simple, age-old principle of supply and demand. At its core, what affects gold prices often boils down to a fundamental question: how much is being pulled from the earth versus how much is being sought after for everything from wedding rings to circuit boards?

On the supply side, you have to understand that gold mining is an incredibly difficult, expensive, and time-consuming process. Opening a new mine can take years and cost billions of dollars. This means supply can't just ramp up overnight to meet a sudden surge in demand. Any disruption—like a labor strike or a political issue in a major gold-producing nation—can instantly tighten supply and put upward pressure on prices.

The Major Sources of Gold Demand

On the other side of that coin, the demand for physical gold is incredibly diverse and comes from all over the globe. It's not just investors and central banks buying; a huge portion of annual gold consumption comes from tangible uses that touch our daily lives.

- Jewelry Manufacturing: This is the single largest and most consistent source of gold demand. In many cultures, especially in places like India and China, gold jewelry isn't just an accessory. It's a critical store of wealth and a cultural cornerstone.

- Industrial Applications: Gold has some truly unique properties—it's an excellent conductor of electricity and doesn't corrode. This makes it absolutely essential in high-end electronics, advanced medical devices, and even aerospace technology.

- Investment Demand: This is the slice of the pie most people think of. It includes the purchase of physical gold bars and coins, as well as shares in gold-backed ETFs by investors looking for a safe haven to park their money.

This constant, built-in demand from the jewelry and industrial sectors creates a strong, reliable floor for gold's value. It ensures that gold is always sought after, even when investor sentiment shifts, which adds a layer of stability to the market you don't see with other assets.

Think about how events on the other side of the world can create predictable spikes in demand. For instance, the wedding season in India, a country with deep cultural ties to gold, consistently drives a massive surge in jewelry buying. This predictable demand wave can influence global prices year after year.

This is a key concept to grasp when you're considering Gold and Jewelry Buying. Knowing that your items have an intrinsic value beyond just investment appeal gives you real confidence. When you decide it's time to sell, you can save the hassle and sell locally for more than online shipments. We provide transparent, hassle-free offers backed by free Xray Scanning and Gold Testing. And with our Price Matching, you're always assured the highest payout in Boise.

Getting the Highest Payout for Your Gold in Boise

Understanding what drives the price of gold is one thing, but actually turning that knowledge into cash in your pocket is what really counts. When you decide it's time to sell, you need a process that’s transparent, fair, and gets you the best possible return.

While online mail-in services might look convenient on the surface, they often hide risks. Think long delays, confusing fees, and a lack of transparency that can seriously eat into your final payout.

There’s a smarter, safer way to sell right here in Boise. You can save the hassle and sell locally for more than online shipments. A trusted local expert offers immediate, tangible advantages that a remote buyer simply can’t compete with, ensuring you receive the highest payout in Boise.

The Local Advantage in Gold and Jewelry Buying

When you choose a local specialist for Gold and Jewelry Buying, you stay in the driver's seat. Instead of sending your valuables off into the mail and just hoping for a good outcome, you get a face-to-face evaluation from a professional who lives and breathes the current market. That direct, personal interaction is the cornerstone of a trustworthy transaction.

Our process is designed for clarity and your confidence:

- Free Xray Scanning and Gold Testing: We use state-of-the-art technology to verify the exact purity and weight of your gold, right in front of you. No mysteries, no guesswork.

- Hassle-Free Offers: You’ll get an immediate, no-obligation offer based on real-time market data. This is your chance to ask questions and get straight answers.

- Price Matching: We're committed to giving you the best price, period. Our price match guarantee means you know you're walking away with the highest possible payout for your gold and jewelry.

Selling locally cuts out the shipping risks, insurance costs, and the uneasy feeling of dealing with a faceless company. You get a firm offer and immediate payment, making the whole experience both secure and profitable.

Working with a local buyer who operates with full transparency is the most effective way to capitalize on your knowledge of the gold market. To stay up-to-date on daily values, check out our insights on the gold market prices today and see how global trends are creating local opportunities.

Common Questions About Selling Gold

Navigating the world of Gold and Jewelry Buying can feel a little intimidating, and it usually brings up a few key questions. Getting solid answers helps you sell with confidence, making sure you walk away with the value you deserve. Let's tackle some of the most common concerns we hear from people.

When Is the Best Time to Sell My Gold Jewelry?

Everyone wants to sell at the absolute peak, but trying to time the market perfectly is a recipe for frustration. It’s nearly impossible. However, understanding what makes gold prices move gives you a massive advantage. Historically, prices tend to rise during times of economic uncertainty or when the U.S. dollar shows weakness.

The most practical approach? Sell when you need the cash and work with a trusted local buyer right here in Boise. A reputable expert will give you a free, no-pressure evaluation based on that day’s market rate. It takes all the guesswork out of the process for you.

How Do I Know I'm Getting a Fair Price?

This is the big one, and the answer is simple. A fair offer always comes down to two things: the current market price of gold (often called the spot price) and the genuine purity of your item (its karat). Transparency is the number one sign of a buyer you can trust.

Look for a Boise business that offers free Xray Scanning and Gold Testing. This is the modern, professional way to verify purity without even scratching your jewelry. A good buyer will walk you through their payout calculation, and you can learn more about how to test gold purity on our blog to be better informed.

A reputable buyer’s process should be an open book. From the moment you walk in to the final offer, you should feel informed, comfortable, and respected. This commitment to clarity is what separates a great transaction from a questionable one.

Plus, selling locally means you can save the hassle and sell locally for more than online shipments. You can compare offers in person and dodge the hidden fees, insurance costs, and long delays that often come with mail-in services, securing the highest payout in Boise.

Does Geopolitical Instability Always Raise Gold Prices?

Geopolitical instability is definitely a major driver, but it isn't a guarantee of higher prices. Gold is the classic "safe-haven" asset. When global conflict or political turmoil creates uncertainty, investors often run to the security of gold, and that increased demand pushes prices up.

But the market is a complex machine. Other powerful forces, like a strengthening U.S. dollar or central banks deciding to sell off their gold reserves, can pull prices in the opposite direction. The price you see on any given day is the net result of all these global factors pushing and pulling against each other.

When you're ready to sell, the experts at Carat 24 - Trusted Gold Experts are here to help. We provide transparent evaluations, hassle-free offers, and a price match guarantee to ensure you always get the highest payout. Visit us today to see what your gold is worth. https://carat24boise.com