If you're looking for a solid investment in a world full of ups and downs, it's hard to beat government-minted bullion coins. Think classics like the American Gold Eagle or the Canadian Maple Leaf. These aren't just collector's items; they're valued worldwide for their purity, easy liquidity, and direct link to the price of gold, making them a cornerstone for anyone serious about preserving their wealth.

Why Gold Coins Are a Smart Investment Choice

In a market dominated by fluctuating stocks and complex digital assets, there’s a unique security that comes from holding a physical investment. Gold coins aren't just numbers on a screen; they're real, durable assets you can actually hold in your hand. It's this tangibility that has made gold a trusted store of value for literally thousands of years.

Experienced investors consistently use gold coins as a powerful tool to protect their wealth and hedge against inflation. When the dollar's buying power weakens, gold has historically held its ground or even climbed in value. It acts as a financial anchor in the middle of an economic storm. Think of it as an insurance policy for your entire portfolio.

The Strategic Advantage of Gold Coins

Deciding to invest in gold is one thing, but choosing the right form of gold is where the real strategy comes in. While big gold bars are great for tucking away large amounts, gold coins offer some distinct advantages that make them a favorite for many investors.

- Exceptional Liquidity: Government-minted coins are known and trusted all over the world. That means you can sell them quickly and easily without taking a big hit on the price.

- Divisibility: Coins are available in various sizes. This gives you the flexibility to sell off smaller portions of your holdings when you need cash, rather than being forced to liquidate an entire large bar.

- Government Guarantee: When you buy a coin like the American Eagle, its weight and purity are backed by the U.S. government. That adds a layer of trust and authenticity you can't get anywhere else.

Finding a Trusted Local Partner in Boise

While the gold market is global, your best asset is often right here at home. Working with a trusted local expert in Boise cuts through the noise and simplifies the entire process of gold and jewelry buying. You get professional, one-on-one guidance without the risks and uncertainty of dealing with faceless online companies.

For local investors, the ability to work with a reputable buyer is key. It allows for transparent transactions, immediate payment, and the confidence that comes from dealing with an expert face-to-face.

When you're ready to sell, you can save the hassle and sell locally for more than online shipments. At Carat 24, we make hassle free offers and are committed to giving you the highest payout in Boise, backed by our Price Matching guarantee. We even provide Xray Scanning and Gold Testing for free, so you know the exact value of what you have. This secure, hands-on approach is why so many people choose a local expert for their precious metal investments.

Bullion vs. Numismatic Coins: What Investors Need to Know

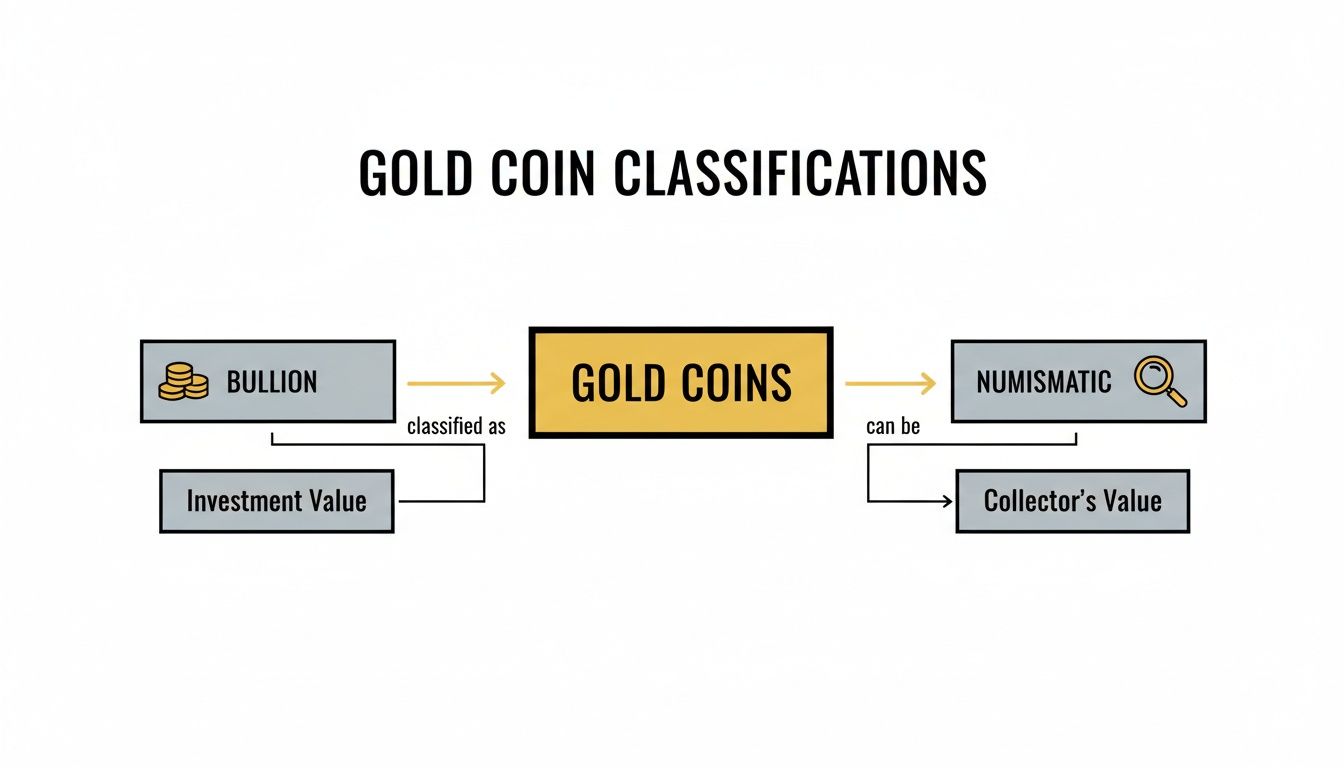

When you decide to put your money into gold, the very first question isn't which coin to buy, but what kind of coin to buy. This single choice sets the entire direction for your investment. The world of gold coins is split into two distinct camps: bullion and numismatic. Getting this difference right is the key to making sure your purchase actually lines up with what you’re trying to achieve financially.

Let's use a car analogy. You could go out and buy a brand-new, reliable sedan right off the factory line. Its value is straightforward—based on its parts, the manufacturing quality, and what the market is paying for that model right now. That's your bullion coin.

Or, you could hunt down a rare, vintage 1960s sports car. The value of that car has almost nothing to do with the raw cost of its steel and rubber. Instead, its price tag comes from its rarity, its unique history, and what passionate collectors are willing to pay for a piece of automotive art. That's your numismatic coin.

The Pure Value of Bullion Coins

Bullion coins are the workhorses of the gold investment world. Their value is almost entirely tied to the amount of precious metal they contain—what we call their "melt value." The price of a popular bullion coin, like an American Gold Eagle or a Canadian Maple Leaf, will move in lockstep with the daily spot price of gold.

Investors gravitate toward bullion for a few solid reasons:

- Direct Gold Exposure: It's the cleanest, most direct way to invest in the price of gold itself. No guesswork.

- High Liquidity: Because their value is standardized and understood everywhere, bullion coins are incredibly easy to buy and sell, whether you're in Boise or Berlin.

- Lower Premiums: The amount you pay over the gold spot price (the "premium") is usually quite small. It just covers the costs of minting, shipping, and a modest dealer profit.

If your goal is to preserve wealth, hedge against inflation, and add a stable asset to your portfolio, bullion coins are the obvious choice. They’re simple, transparent, and do one job extremely well.

The Collector's World of Numismatic Coins

Numismatic coins are a different game entirely. Their value comes from factors that have little to do with their gold content. We're talking about rarity, historical importance, the coin's physical condition (its "grade"), and pure collector demand. A rare coin from a year with a low mintage could be worth thousands of dollars, even if its actual melt value is only a fraction of that.

The key takeaway is this: With bullion, you are investing in gold. With numismatics, you are investing in a collectible artifact that just happens to be made of gold.

This is a critical distinction. While numismatic coins can sometimes deliver spectacular returns, they behave more like the fine art market than a commodity market. Prices can be subjective and aren't necessarily tied to the day-to-day movements of the gold price. To really get into the weeds on this, you can learn more about the factors that determine numismatic coin value in our detailed guide.

Which Is Right for You?

For the vast majority of people looking for the best gold coins for investment, bullion is the clear winner. It delivers the stability, liquidity, and direct exposure to the gold market that investors need to protect and grow their wealth. Numismatics are best left to seasoned collectors who have a deep, specialized knowledge and a genuine passion for the hobby itself.

Whether you're looking to sell a coin collection you inherited or are just starting to build one, understanding this fundamental difference is crucial to getting the best value. Here at Carat 24, we specialize in both gold and jewelry buying, offering expert evaluations for both your bullion and numismatic pieces. We give hassle free offers and ensure you walk away with the highest payout in Boise, backed by our Price Matching guarantee. Our process always includes Xray Scanning and Gold Testing for free, so you have total confidence in the true value of your assets. When you're ready, save the hassle and sell locally for more than online shipments.

The 5 Best Gold Coins for Building Your Portfolio

Alright, now that you've got a handle on the critical difference between bullion and numismatic coins, we can get to the fun part—choosing your assets. Think of this section as your curated "shopping list" for the best and most reliable gold coins for investment. We're going to walk through the top five government-minted coins that are recognized, trusted, and easily traded all over the world.

Each coin has its own personality and perks. It's a bit like comparing the most dependable truck models for a long haul—they'll all get the job done, but one might have features that are a perfect fit for your specific needs. By the time you're done here, you’ll know exactly what you’re looking for.

This chart is a great visual reminder of the two paths a gold coin's value can take: straight investment or the more complex world of collectibles.

As you can see, bullion coins are all about their direct connection to the value of gold itself, while numismatic coins pull their value from rarity and collector demand. We're sticking with bullion.

1. The American Gold Eagle

The American Gold Eagle is, without a doubt, the heavyweight champion of gold coins, especially here in the United States. Minted since 1986, its weight and purity are guaranteed by the U.S. government, making it a true cornerstone for any investor's portfolio.

It’s a 22-karat coin, which means it’s 91.67% pure gold. The rest is a mix of silver and copper, an alloy that makes the coin tough as nails and resistant to scratches—a huge plus when you're handling physical gold. And don't worry, even with the alloy, a 1 oz coin contains precisely one full troy ounce of pure gold.

Because of its incredible popularity and government backing, the American Gold Eagle boasts unmatched liquidity. It's the coin you can sell almost anywhere, anytime, at a fair price. This makes it the go-to choice if you value being able to trade easily.

2. The Canadian Gold Maple Leaf

Next up is the Canadian Gold Maple Leaf, a coin famous for its stunning purity. The Royal Canadian Mint started producing these in 1979, and they were one of the first bullion coins to hit the market with .9999 fineness, which is pure 24-karat gold.

This incredible purity makes it a favorite for investors who want nothing but gold in their coins. But that's not all. The Maple Leaf also comes packed with cutting-edge security features, like microscopic radial lines and a tiny, laser-engraved privy mark, making it a nightmare to counterfeit. These details give both buyers and sellers a ton of confidence.

If you'd like a deeper dive, you can explore the unique characteristics of the Gold Maple Leaf coin in our dedicated guide to see what makes it such a solid pick.

3. The South African Krugerrand

Meet the original—the South African Krugerrand. First minted way back in 1967 to help market the country's gold, it literally set the standard for every investment coin that came after it. Just like the American Eagle, it’s a durable 22-karat coin made from a gold-copper alloy.

Its long and storied history means the Krugerrand is known and traded in every corner of the globe. It also frequently has one of the lowest premiums over the spot price of gold, making it a fantastic option for anyone trying to get the most gold for their money. It's no surprise that the Krugerrand, along with the Eagle and Maple Leaf, dominates the global secondary market.

4. The British Britannia

Issued by the prestigious Royal Mint in the UK, the British Britannia beautifully blends rich history with modern investment savvy. Since 2013, the Gold Britannia has been minted in pure 24-karat (.9999 fine) gold.

The coin proudly features the iconic figure of Britannia, a powerful symbol of British strength. Similar to the Maple Leaf, the newer Britannias are loaded with sophisticated security features, including a latent image that changes as you tilt it and micro-text that's nearly impossible to copy. It also carries a unique tax advantage for UK residents, making it a top choice in that market.

5. The Australian Kangaroo

Produced by the highly respected Perth Mint, the Australian Kangaroo (sometimes called the Gold Nugget) has a unique twist—its design changes every single year. This gives it a slight collector's edge on top of its solid bullion value.

Each coin is minted in .9999 fine (24-karat) gold and is celebrated for its impeccable finish and gorgeous, detailed artwork. The annually changing kangaroo design makes it a favorite for investors and collectors who enjoy having some variety in their stack.

Comparing the Top Investment Gold Coins

Feeling a little overwhelmed by the choices? That's perfectly normal. This table breaks down the key stats for each coin so you can see how they stack up at a glance.

| Coin Name | Purity (Fineness) | Country of Origin | Key Investor Benefit |

|---|---|---|---|

| American Gold Eagle | 22-Karat (.9167) | United States | Unbeatable liquidity and recognition |

| Canadian Gold Maple Leaf | 24-Karat (.9999) | Canada | Exceptional purity and advanced security |

| South African Krugerrand | 22-Karat (.9167) | South Africa | Low premiums and deep global market |

| British Britannia | 24-Karat (.9999) | United Kingdom | High purity with modern security features |

| Australian Kangaroo | 24-Karat (.9999) | Australia | Changing annual design adds collector appeal |

Each of these coins is a world-class asset. The "best" one really just comes down to your personal priorities—whether that's maximum purity, the lowest premium, or ultimate liquidity. You can't go wrong with any of them.

How Purity, Premiums, and Liquidity Affect Your Returns

Picking a well-known coin like an American Gold Eagle is a solid start, but if you really want to maximize your returns, you have to look under the hood. Three powerful forces are always at play, determining what your coin is worth and how easily you can turn it back into cash: its purity, the premium you pay, and its liquidity.

Getting a handle on these concepts is what separates a casual buyer from a strategic investor. It’s a bit like buying a car. Two models might look similar, but one has a more powerful engine (purity), a lower dealership markup (premium), and is a popular model that’s easy to sell later (liquidity). These are the factors that truly define a good investment.

The Great Purity Debate: 24-Karat vs. 22-Karat

When you see a coin described as 24-karat or .9999 fine, you’re holding virtually pure gold. Coins like the Canadian Gold Maple Leaf and the American Gold Buffalo are in this camp. They're celebrated for delivering the maximum possible gold content, which is a huge draw for investors who just want to stack pure metal.

On the other side, you have 22-karat coins, which are 91.67% pure gold. The legendary American Gold Eagle and South African Krugerrand are famous examples. They are alloyed with small amounts of copper and silver, but don't get it twisted—a 1 oz American Eagle still contains exactly one troy ounce of pure gold. The extra metals just make the coin harder and more resistant to scratches, a practical perk for a tangible asset.

If you'd like to dive deeper into how this is measured, you can check out our guide on how to determine gold purity.

Decoding the Premium Over Spot

The "premium" is simply the amount you pay above the gold's raw market value, or "spot price." This extra bit covers the costs of minting, distribution, and the dealer’s profit. Premiums aren't set in stone; they move up and down based on the coin's reputation, current demand, and even the mint's production schedule.

For instance, a 24-karat coin like the Canadian Gold Maple Leaf often carries a slightly higher premium because you're getting pure gold. In contrast, 22-karat coins like the American Gold Eagle typically trade at lower premiums. However, during times of high demand, premiums on popular coins like the Eagle can jump from a historical average of 3-4% to as high as 5-8% over spot. This shows just how much market dynamics can influence your entry price.

Liquidity: The Ultimate Mark of a Great Investment

Purity and premiums affect your initial cost, but liquidity determines your exit strategy. Simply put, liquidity is how quickly and easily you can sell your gold coin for a fair market price. For an investor, this might be the single most important factor. A coin isn't a good investment if you can't sell it when you need to.

This is where recognizable, government-minted coins really shine. Their universal acceptance means you have a global market of buyers ready to go at a moment's notice.

High liquidity protects your investment. It ensures you can convert your gold back into cash without taking a big discount, giving you true financial flexibility.

When you're looking for the best gold coins for investment, always prioritize the ones with the deepest, most active markets. While purity and liquidity are crucial, the long-term profitability of your gold is also heavily influenced by tax considerations, like differentiating between short term vs long term capital gains. Getting this final piece of the puzzle right ensures you keep more of your hard-earned returns.

Here at Carat 24, we make the process of buying and selling gold simple. We provide hassle-free offers and the highest payout in Boise. You can save the hassle and sell locally for more than online shipments, all with the confidence of our Price Matching guarantee and free X-ray Scanning and Gold Testing.

Selling and Buying Gold Coins in Boise

Once you've decided to buy or sell investment-grade gold coins, you hit the next crucial fork in the road: where and how to do it. While the internet throws a world of options at you, folks here in the Boise community have a serious advantage right in their own backyard.

Working with a trusted local expert can completely change the game. It turns what can be a risky, faceless online process into a secure, straightforward, and profitable experience.

Mail-in services might seem convenient at first glance, but they’re often riddled with hidden costs and big headaches. You're left navigating the tricky world of insuring high-value shipments, dealing with the stress of your assets being out of your hands, and waiting around for evaluations and payments. In the end, that "convenience" can take a real bite out of your returns.

The Clear Advantages of Selling Locally

When you choose to sell your gold coins here in Boise, you flip the script. The entire process is transparent, instant, and designed to leave more money in your pocket. There's simply no better way to get a fair, real-time value for your investment.

Here’s what that looks like in practice:

- Immediate Payment: You walk in with your gold coins and you can walk out with cash in hand. No waiting for checks to clear or dealing with processing delays.

- Transparent Evaluations: You’re right there for the entire evaluation. You can ask questions and see exactly how your coins are assessed, which builds a ton of confidence and trust.

- No Hidden Fees: You completely sidestep the expensive shipping and insurance fees required by online dealers. The price you're offered is the price you get.

At Carat 24, we’ve built our reputation on a foundation of trust. We offer a completely hassle-free process for both gold and jewelry buying, all aimed at getting you the highest payout in Boise. We even back it up with a Price Matching guarantee, so you can have total peace of mind.

A Process Built on Trust and Technology

To make sure every transaction is perfectly accurate and fair, we start with a professional assessment. We provide Xray Scanning and Gold Testing for free, using state-of-the-art technology to verify the exact purity and weight of your coins. This scientific approach takes out all the guesswork and ensures our offer is based on cold, hard data.

Based on that transparent evaluation, you get an on-the-spot, no-obligation offer. It’s why so many of your neighbors in Boise choose to save the hassle and sell locally for more than online shipments. The whole thing is designed to be secure, simple, and respectful of both your time and your investment.

Choosing a local, reputable dealer for your gold coin transactions is one of the most effective ways to minimize risk. It replaces the uncertainty of mail-in services with the assurance of a face-to-face, professional evaluation.

The U.S. jewelry and bullion market is huge, with around 61,900 jewelers and hundreds of specialized dealers. This competitive landscape actually empowers local experts to offer better service, including multi-step authentication and solid buyback programs. Engaging with a trusted professional in this ecosystem is the single best way to cut down on counterparty and authenticity risk.

For a deeper dive into navigating this landscape, you can find out where to sell gold coins for the best value in our in-depth article. By understanding the local market, you can make sure your transactions are both safe and highly profitable.

Answers to Your Top Gold Coin Questions

When you're thinking about adding gold coins to your strategy, it's only natural for questions to pop up. Let's walk through some of the most common ones we hear from investors, breaking down the answers in a way that helps you move forward with confidence and sidestep the usual mistakes.

How Much of My Portfolio Should I Put Into Gold?

This is probably the most critical strategic question anyone can ask, and the answer isn't a one-size-fits-all magic number. However, a good rule of thumb you'll hear from many financial pros is to allocate somewhere between 5% to 10% of your total portfolio to precious metals.

Why that range? It's generally seen as the sweet spot—enough to act as a real buffer against inflation and market turbulence, but not so much that you're overly exposed to the price movements of a single asset. Think of it less as the engine of your portfolio and more as the heavy anchor that keeps your financial ship stable when the economic seas get rough. Your own comfort with risk and your long-term goals will help you decide where you fall in that 5% to 10% range.

What’s the Best Way to Keep My Gold Coins Safe?

Once you take physical possession of your gold, security becomes priority number one. You've really got three main paths to choose from, and each has its own trade-offs.

- A High-Quality Home Safe: This gives you the most immediate access to your gold. The downside is that it requires a serious investment in a top-tier, heavy-duty safe and probably a good home security system. You'll also need to double-check that your homeowner's insurance policy specifically covers the full value of what you're storing.

- Bank Safe Deposit Box: This is a very common and pretty affordable option. A bank vault offers great protection from theft. The main drawbacks are that you can only get to your coins during banking hours, and—this is a big one—the contents are not insured by the FDIC. You'll need to arrange for separate insurance.

- Third-Party Vault (Depository): For larger holdings, this is the gold standard of security. Professional depositories are insured, regularly audited, and built from the ground up to protect precious metals. It's the most secure route, but it does come with annual storage fees.

How Do I Know for Sure a Gold Coin Is Real?

Honestly, the single best way to avoid fakes is to start by buying from a reputable, established dealer. A professional has the experience and the right equipment to spot a counterfeit instantly, protecting you from some of the very convincing fakes that are out there.

The only way to be 100% certain is through professional testing. Here in Boise, we offer free Xray Scanning and Gold Testing to give our clients total peace of mind. It’s a scientific process that completely removes any doubt.

The same logic applies when it's time to sell. You'll always get the highest payout in Boise by working with an expert who can accurately assess what your coins are worth. We provide hassle free offers and back them up with our Price Matching promise, so you can save the hassle and sell locally for more than online shipments. Our entire Gold and Jewelry Buying business is built on that kind of trust and transparency.

Ready to Start Your Gold Investment Journey?

You've just walked through the essentials of choosing the best gold coins for investment. We’ve unpacked the critical difference between straightforward bullion and collectible numismatic coins, and we’ve put the spotlight on market heavyweights like the American Eagle and Canadian Maple Leaf. Most importantly, we've shown why having a trusted local partner is invaluable.

The big takeaway here is confidence. You now have a solid framework for making smart, strategic moves that align with your goal of building real wealth with physical gold. This isn't the end of your journey—it's the first step.

Taking the Next Step in Boise

If you're in or around Boise, it's time to turn that knowledge into action. While doing your homework online is a great start, there's no substitute for the peace of mind that comes from a professional, face-to-face consultation. It's your chance to hold the coins, ask pointed questions, and get advice that's actually geared toward your financial situation. This is a vital step, and so is looking into solid asset protection insurance to keep your new assets secure.

An informed investment isn't just about knowing the asset; it's about verifying every detail. A local expert provides that final, crucial layer of assurance, turning a good decision into a great one.

When you work with a local specialist for your Gold and Jewelry Buying needs, you’re not just making a transaction. You're building a relationship based on honesty and trust, which ensures you get the highest payout in Boise when the time comes to sell. We always say, save the hassle and sell locally for more than online shipments.

Your Local Gold Partner in Boise

Our promise is to make your experience both simple and profitable. We make Hassle free offers and stand by them with our Price Matching guarantee.

To keep everything completely transparent, we provide complimentary Xray Scanning and Gold Testing for free. You'll know the exact value of what you have, down to the last detail. This is especially important when you’re dealing with graded coins. If you want to dive deeper, check out our guide on what makes a certified gold coin truly valuable.

We invite you to stop by for a professional, no-pressure consultation. Let us help you take the next confident step in your investment journey and turn your knowledge into a tangible, high-value portfolio.

Ready to buy or sell with confidence? Visit Carat 24 - Trusted Gold Experts at our Boise location for a transparent evaluation and the best local payouts. Start your investment journey with a team you can trust. https://carat24boise.com