Turning a lifetime of possessions into fair market value can feel like a monumental task, but a solid pricing guide is your roadmap. The core idea is to price items somewhere between 20-60% of what they cost new. Where an item lands in that range depends on its condition, how rare it is, and what buyers are looking for right now. This strategy is all about hitting the sweet spot—attracting eager buyers while still getting a fair return.

The Foundations Of Smart Estate Sale Pricing

Pricing the contents of an entire home is a massive puzzle. You're not just selling stuff; you’re managing a legacy and trying to liquidate assets as efficiently as possible. The key is to approach it all with a clear, strategic mindset and leave emotion at the door, which can seriously cloud your judgment.

Think of it as a friendly negotiation. Your goal is to find that perfect price where both you and the buyer walk away feeling like you got a great deal. It’s all about finding the fair market value for each and every item. This isn't about what something cost 30 years ago or how much sentimental value it holds. It’s about what a willing buyer will realistically pay for it, at your sale, on that specific weekend.

Balancing Profit and a Quick Sale

The most successful estate sales walk a fine line between making the most money possible and ensuring a quick, complete cleanout. If you price everything too high, you’ll be stuck with a house full of unsold goods when the sale ends. Go too low, and you're leaving a lot of money on the table.

The single biggest mistake is pricing based on original purchase price or sentiment. An effective estate sale pricing guide always prioritizes current market demand and what an item can realistically sell for today.

This shift in perspective is everything. Instead of asking, "What was this worth?" you have to start asking, "What will someone pay for this now?" Answering that one question accurately turns a daunting task into a rewarding one.

Understanding the 20-60% Rule

So, where do you start? A good rule of thumb that’s been used in the industry for years is pricing items at 20% to 60% of their original retail price. The exact percentage really depends on the item's category, its condition, and current demand.

For example, high-quality antiques and rare collectibles in excellent shape might fetch 50%-60% of their retail value. On the other hand, everyday household goods like kitchenware or basic furniture usually fall into the 20%-40% range. This is the balance we’re talking about—it’s how you attract bargain hunters while ensuring the seller gets a reasonable return on the assets. For more context, you can explore more pricing history insights about this topic.

Here’s a quick-reference table to give you a clearer picture of how this works across different categories.

General Pricing Rules Of Thumb For Estate Sales

| Item Category | Typical Percentage Of Retail Price | Key Considerations |

|---|---|---|

| Furniture | 30% - 60% | Designer or antique pieces command higher prices. Scratches, stains, or outdated styles will lower the value significantly. |

| Appliances | 20% - 50% | Newer models in perfect working order sell best. Age and visible wear are major factors. |

| Kitchenware | 20% - 40% | Complete sets of china or popular brands like Pyrex sell better. Everyday dishes and glassware are on the lower end. |

| Clothing | 10% - 30% | Designer labels, vintage pieces, and unworn items with tags will fetch more. Standard used clothing sells for very little. |

| Books | 10% - 50% | Most common paperbacks are priced low. First editions, signed copies, or rare collections are the exception. |

| Art & Collectibles | 40% - 60%+ | Value is highly dependent on the artist, rarity, and condition. Professional appraisal is often necessary for high-value pieces. |

Remember, this table is just a starting point. Local demand and the overall quality of the items will always play a huge role in your final pricing decisions.

Special Considerations for High-Value Items

While most household goods fit neatly into those general rules, some assets are in a league of their own and need a more specialized approach.

- Gold and Jewelry Buying: Precious metals and fine jewelry are a different ballgame. Their value is tied directly to fluctuating market prices and the purity of the materials, not just how they look.

- Local Expertise Matters: To get the highest payout in Boise, working with local experts is non-negotiable. You can avoid the hassle and risk of shipping valuable items online and often get a better price right here at home.

- Professional Services: Look for a buyer who offers hassle-free services like free Xray Scanning and Gold Testing. This allows them to determine the precise value without damaging your heirlooms. A reputable local buyer will often even offer Price Matching to make sure you’re getting the best possible deal in the area.

The Three Pillars Of Accurate Item Valuation

To run a successful estate sale, you first have to get inside the mind of a buyer and understand what gives an item value in the first place. It’s not about what someone originally paid for it or how much sentimental history it holds. True market value comes down to three core pillars: Condition, Rarity, and Demand.

Think of these as the fundamental rules of the game. Once you know them, you can price items to sell—and sell well.

Pillar 1: Condition

Let’s start with Condition. This one is pretty intuitive. Imagine you're looking at a used car. A vehicle with low mileage and a flawless interior is always going to fetch a higher price than the exact same model that’s covered in dings and has a worn-out engine.

It’s no different in an estate sale. A vintage Pyrex bowl with zero chips and vibrant, unfaded color is far more desirable than one that’s scratched up from decades of use. Even tiny flaws can knock the final price down significantly. Be honest and critical here.

Pillar 2: Rarity

Next up is Rarity. Picture two different chairs. One is a standard, mass-produced IKEA chair—totally functional, but you can find thousands just like it. The other is a signed, limited-edition piece from a well-known local artist.

The IKEA chair’s value is purely functional, which means it’s low. The artist’s chair, however, gets its value from scarcity. It’s simple economics: when something is hard to find, its value naturally goes up.

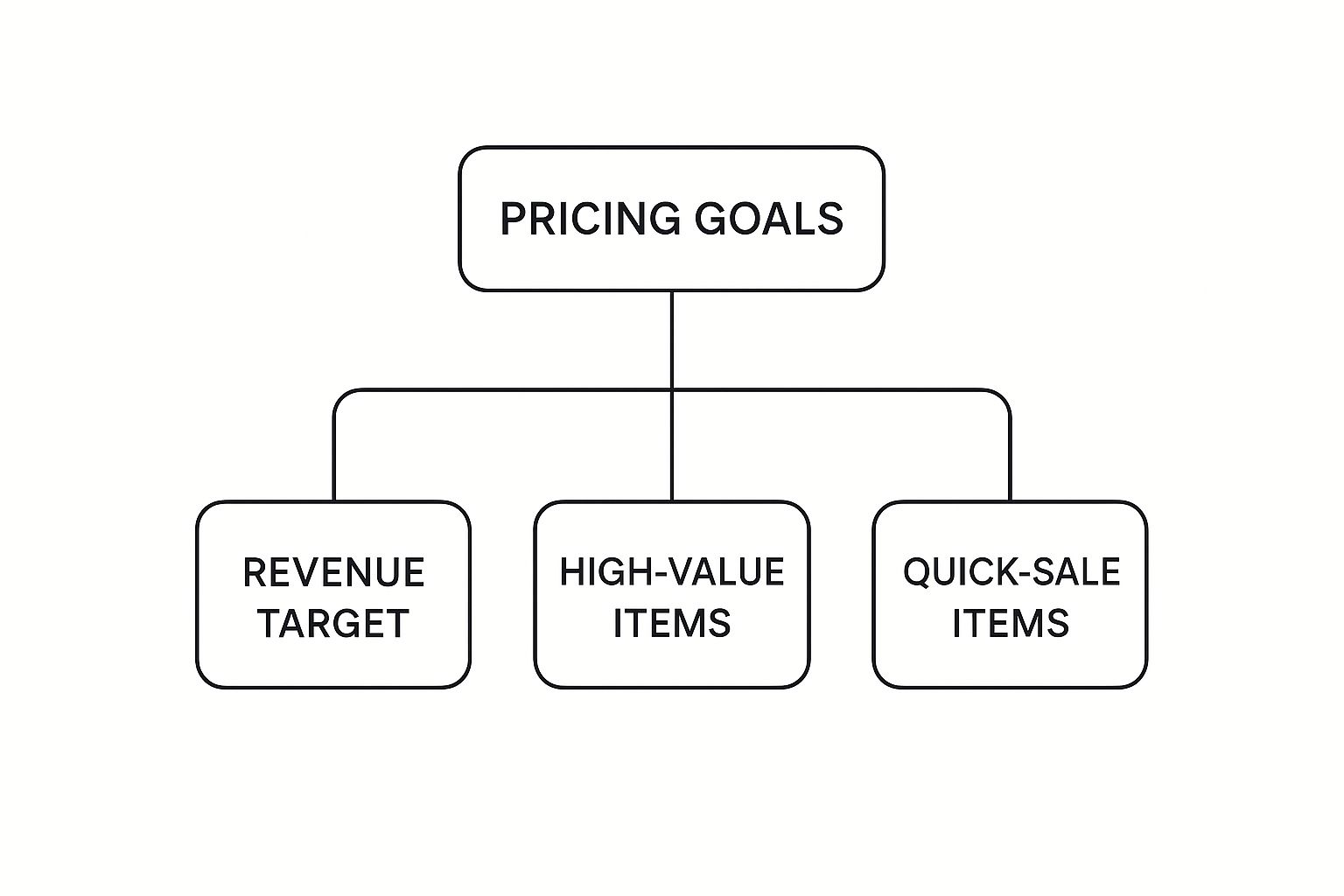

This infographic breaks down how to structure your pricing goals, balancing high-value items against those you just need to move quickly.

As the visual shows, a balanced strategy is key. You want to segment your inventory to maximize profit on the star pieces while still clearing out all the everyday goods efficiently.

Pillar 3: Market Demand

The final pillar, Demand, is the most fluid and exciting of the three. It’s all about what buyers want right now. A perfect example is the explosion in popularity of mid-century modern design. Twenty years ago, a teak credenza from the 1960s might have been written off as dated. Today? That same piece could be the star of the show, bringing in serious cash.

Trends come and go, so keeping a finger on the pulse of what's hot is crucial. Demand is the bridge connecting your items to real, eager buyers who are ready to pay a premium for the styles and objects they're hunting for. An item can be in mint condition and incredibly rare, but if nobody wants it, it simply won't sell for top dollar.

The X-Factor: Provenance

Beyond the three pillars, there’s a powerful fourth factor that can send an item's value soaring: provenance. This is the documented history—the story—behind an item.

A simple antique pocket watch is one thing. But what if that same pocket watch comes with a photo and a letter proving it was carried by a soldier in a historic battle? Now you have something special.

Provenance transforms an object from a simple commodity into a piece of history. A compelling and verifiable story can sometimes double or even triple an item's value because it adds a layer of uniqueness that cannot be replicated.

This is especially true for collectibles, art, and high-end antiques. If you can authenticate an item's history, you elevate its worth. For instance, authenticating a luxury watch is a highly detailed process. To see what goes into it, check out our guide on how to authenticate Rolex watches.

Handling High-Value Heirlooms

When you get to gold, jewelry, and other precious items, these same valuation principles apply, but the stakes are much higher. The demand for gold is always there, but its value is tied directly to purity, weight, and the daily whims of the market.

This is where you need to be extra careful. Guessing is not an option. Your best move is always to seek professional guidance. To get the highest payout in Boise, you can skip the hassle of shipping things off and sell locally for more.

Reputable local buyers provide hassle-free offers and services like free Xray Scanning and Gold Testing to get a precise value without damaging your items. Many even offer Price Matching to guarantee you’re getting the best deal. Taking this step ensures you don't accidentally undervalue some of the most precious assets in the estate.

Strategic Pricing For Different Item Categories

Alright, now that you've got the basic principles down, it's time to get into the real work. An estate is never just one thing; it's a mix of everything from a solid oak dresser to a delicate porcelain teacup. A one-size-fits-all pricing gun just won't cut it here.

The real art of running a successful estate sale is knowing how to spot the value in each category of item. This is where you put theory into practice. You have to know what makes an antique valuable versus what makes a vintage piece desirable, and price both to sell. Let's break down the common categories you'll run into.

Valuing Furniture: Antique vs. Modern

Furniture is often the biggest and most visible stuff in any home. The first step is figuring out what you're looking at. Is it an antique that’s over 100 years old? A vintage piece from the last 20-99 years? Or just a modern, functional item?

An old roll-top desk, for instance, gets its value from its history, how it was made, and how many are left. But a vintage mid-century modern credenza? Its price is all about today's design trends and who made it. And that modern IKEA bookshelf? Its value is pretty much just what someone will pay to not have to build a new one.

- Antique Pieces: First, hunt for any maker's marks or signatures. Check for signs of quality, like dovetail joints in the drawers and solid wood construction. These can often sell for 40-60% or more of their appraised value.

- Vintage Finds: Condition and style are everything. A flawless piece from a hot design era can be a big-ticket item. Your best bet is to look up what similar items have actually sold for on online marketplaces.

- Modern Items: Price these to go. A good starting point for modern furniture in great shape is usually 20-30% of what it cost new.

Pricing Electronics and Books

Electronics are tough. They lose value faster than almost anything else. That amazing TV from five years ago might be worth very little today. The number one rule is to test everything to make sure it works, then price it aggressively.

Books, on the other hand, can be a total wildcard. Most of them are best sold in bulk—think "fill a bag for $5." But you have to check them first, because you might be sitting on a goldmine.

Always flip open the first few pages. Look for first editions, signed copies, or unique collections. A single rare book can be worth more than a roomful of paperbacks. Never just assume—always check the copyright page.

High-Value Antiques and Collectibles

This is where you need to put on your detective hat. Valuing antiques and collectibles isn't about guesswork; it's methodical research.

Imagine you come across a jar of old coins. Some are just pocket change, but others could be rare numismatic treasures. You'd need to look at each one closely. For a great example of this process, learning how much Walking Liberty half dollars are worth gives you a fantastic peek into what makes a collectible valuable. It helps you see the difference between a cool old coin and a piece of history.

Case Study: Pricing an Antique Vase

- Initial ID: You find a porcelain vase. The first thing you do is flip it over and look for a maker's mark. A quick search tells you it's from a respected 19th-century German factory.

- Condition Check: You run your fingers over it, looking for chips, cracks, or repairs. You spot a tiny, hairline crack near the top. This detail is critical.

- Market Research: Using the maker's mark and style, you check "sold" listings on auction sites like LiveAuctioneers or WorthPoint. You see several perfect examples sold for around $500.

- Final Price: Because of that small crack, you price the vase at $275. You're sure to note the flaw on the price tag. This transparency justifies the lower price and builds trust with your buyers.

See? This step-by-step approach takes the guesswork out and bases your price on real-world data.

Dealing With Gold And Jewelry

When it comes to Gold and Jewelry Buying, the game changes completely. These items aren't valued on looks alone. Their worth comes from the raw materials—the karat weight of the gold, the quality of the gems, and the day's market prices. Trying to price this yourself is a huge risk and often leads to getting far less than you should.

For these high-value pieces, the smartest move is to get a professional, no-hassle offer. To get the highest payout in Boise, it's always better to save the hassle and sell locally for more than online shipments. A trusted expert can offer services like free Xray Scanning and Gold Testing, which gives you an exact valuation without damaging your items. Look for a buyer who offers Price Matching; it's your guarantee that you're getting the best possible offer in the area.

Unlocking The Value Of Gold And Fine Jewelry

When you're sorting through an estate, most items play by the same general rules: condition, rarity, and demand. But the moment you uncover gold, fine jewelry, or other precious metals, you’ve stepped into an entirely different arena. These aren't like furniture or old collectibles. Their value is tied directly to global markets, purity, and weight—complex factors a quick Google search just can't nail down.

Trying to price these pieces yourself is hands-down one of the biggest and most expensive mistakes you can make during an estate sale. An uneducated guess could have you pricing a precious family heirloom for a tiny fraction of its real worth, potentially leaving thousands of dollars on the table. This is exactly why a professional evaluation for gold and jewelry is absolutely non-negotiable.

Why Professional Evaluation Is Crucial

It helps to think of gold and fine jewelry as their own unique kind of currency. Their value literally changes every single day based on market spot prices. A simple "14K" stamp on a piece doesn't even begin to tell the whole story.

Figuring out the authenticity, gemstone quality, and the exact metal content is a complex puzzle. This is where specialized tools and years of expertise become critical. A seasoned expert can instantly tell the difference between a natural diamond and a synthetic one, or precisely identify the purity of a gold alloy. These are distinctions that make a massive difference in the final payout.

The biggest financial risk in any estate sale isn't overpricing a common item—it's drastically undervaluing a precious one. For gold and jewelry, a professional assessment is your only real safeguard against this costly error.

For example, certain items like intricately crafted Italian gold have unique characteristics and value markers that only a trained eye can properly identify and assess. If you're curious about what makes some gold stand out, you can learn more about the distinct qualities of what is Italian gold in our detailed guide.

The Boise Advantage: Selling Locally

Once you've set aside the precious metals, your next big decision is how to sell them. Online mail-in services might seem convenient on the surface, but they often come with hidden risks and lower returns. The moment you drop your valuables in the mail, you lose all control, and the offers that come back can be disappointingly low.

This is why it's so important to save the hassle and sell locally for more than online shipments. Working with a trusted local expert right here in Boise gives you transparency and, just as importantly, peace of mind. You get to be present for the entire evaluation, ask questions as they come up, and receive a solid offer on the spot.

Here’s what a reputable local buyer should provide:

- Hassle-free offers based on transparent, real-time market data.

- The highest payout in Boise, often backed by a Price Matching guarantee.

- The security of a face-to-face transaction without the risks of shipping.

The Power Of Advanced Gold Testing

A key benefit of selling to a local professional is getting access to advanced, non-destructive testing methods. Are you worried that testing might damage delicate family heirlooms? With modern technology, that's a concern of the past.

Leading local experts now provide free Xray Scanning and Gold Testing. This technology, known as X-ray fluorescence (XRF), can analyze the precise elemental composition of your items without leaving so much as a scratch. It instantly tells you the exact purity (karat) of the gold and verifies the authenticity of other precious metals.

This transparent, scientific approach takes all the guesswork out of the process. It ensures you're paid for the precise value of what you own, giving you the confidence that you're getting the best possible price for some of the most valuable assets in the estate.

Navigating Market Trends And Local Boise Factors

Pricing items for an estate sale isn’t something you can do in a vacuum. It’s a direct response to the world outside—the economic shifts and cultural tastes that shape what people want to buy and how much they’re willing to pay. Think of it like a sailor navigating the seas. A good captain knows where they want to go, but a great captain understands the winds and tides to get there without a hitch.

Learning to read these market currents is what separates an average sale from a truly profitable one. Your entire valuation strategy has to be grounded in real-world supply and demand. The big picture, like national economic news, sets the stage. But the real magic happens when you zoom in on the local Boise market and figure out what our community is looking for.

Connecting Real Estate Trends To Item Value

Believe it or not, the health of the local real estate market is a huge signal for estate sale pricing, especially for the big-ticket stuff. When luxury homes are selling quickly in places like the Boise Foothills, it creates a ripple effect. Suddenly, there's more demand for the high-end furnishings, fine art, and unique collectibles that go inside those beautiful properties.

Recent data shows luxury home prices have been climbing at an impressive clip—sometimes twice as fast as the rest of the market. This creates a sense of optimism, and buyers are often more willing to invest in premium estate finds. But you also have to balance that with the fact that overall real estate transactions have cooled off a bit, meaning some folks are still cautious. For a deeper dive, you can read the full real estate analysis here.

The key is to balance the optimism of a strong luxury market with the cautious spending habits of the average buyer. Your pricing must reflect this dual reality to attract the widest possible audience.

So what does this mean in practice? You might price that designer mid-century sofa with more confidence, knowing there’s a buyer for it, while pricing the everyday kitchenware more competitively to ensure it moves. It’s all about playing the strategist.

Local Boise Demand And Collector Communities

While national trends give you a broad forecast, every sale is ultimately local. What’s hot in Los Angeles might be a total dud here in Boise, and vice versa. Getting a feel for the specific tastes of the Treasure Valley is absolutely critical.

- Regional Styles: Is the modern farmhouse look still king in Boise? Or is there a growing appetite for sleek, mid-century modern pieces? Paying attention to local design trends helps you know which items to feature and how to price them.

- Collector Hotspots: Every city has its own passionate collector groups. Here in Boise, you might find a surprisingly active community of vintage vinyl hounds, antique firearm enthusiasts, or people who specifically collect art from Idaho artists. When you tap into these niche markets, you can price those items for their true collector value, not just their functional worth.

This local-first approach is even more vital when you're dealing with assets like precious metals. For Gold and Jewelry Buying, you can save the hassle and sell locally for more than online shipments. A trusted Boise expert provides hassle-free offers and can provide on-the-spot services like free Xray Scanning and Gold Testing.

This is how you get the highest payout in Boise, often with a Price Matching guarantee that ensures you’re getting a fair deal based on up-to-the-minute data. To see how the pros do it, you can learn more about the spot price for gold and silver. Working with a local expert protects you from the risks and lower payouts that often come with mailing your valuables off to a faceless online company.

Your Estate Sale Pricing Questions Answered

Even with the best guide in hand, you’re going to hit a few tricky spots when pricing. It just happens. Getting through these practical challenges is what separates a frustrating sale from a successful one. Let's walk through some of the most common dilemmas I see people face.

How Should I Price Items That Are Sentimental But Not Valuable?

This is, without a doubt, the biggest hurdle for most families. You have to learn to separate your emotional attachment from an item's actual market value. A potential buyer sees a comfortable old armchair; they don't see the decades of memories you have associated with it.

The most practical approach? Price these pieces based on what similar, used items sell for locally. Treat them just like any other common household good. This gives them the best chance of finding a new home.

If an item is simply too precious to let go for a low price, the answer is simple: don’t sell it. It’s far better to offer it to another family member or find a special place for it in your own home. Overpricing something due to sentiment almost guarantees it will be left sitting there when the sale is over.

What Is The Best Way To Handle Pricing For A Large Collection?

When you stumble upon a large collection—whether it's stamps, coins, dolls, or anything else—pumping the brakes is crucial. Trying to sell these items piece-by-piece without expert input is a huge financial risk. You could easily undervalue a hidden gem worth hundreds or even thousands.

Your first and most important step is to get a professional appraisal from someone who specializes in that exact category. They are the only ones who can spot the key, high-value pieces that need to be handled differently from the rest. Once you have their evaluation, you can make a smart decision: sell the collection as a single lot, consign it to a specialty auction, or price individual items for your own sale. Don't guess on this one.

Should I Lower Prices On The Last Day Of The Sale?

Absolutely. A final-day discount isn't just a good idea; it's a standard, highly effective estate sale strategy. It's common practice to slash prices by 25% to 50% on the last day. This lights a fire under shoppers and creates a powerful sense of urgency that helps clear out remaining inventory.

Remember, the main goal of an estate sale is to liquidate assets. It's always better to sell an item at a discount than to be stuck with the cost and hassle of hauling it away after the sale.

Make sure you announce the discount with big, clear signs to attract bargain hunters. A "Half-Price Sunday" can easily turn a decent sale into a fantastic one, ensuring almost everything is gone by closing time.

However, this strategy does not apply to high-value assets like gold, fine jewelry, or luxury watches. You don't give those away at a 50% discount. For specialized items, you need a different game plan; for example, it’s critical to understand how to sell a Rolex watch or other valuables through a dedicated expert.

This is exactly where professional Gold and Jewelry Buying services are essential. You can save the hassle and sell locally for more than online shipments. A trusted expert right here in Boise provides hassle-free offers, free Xray Scanning and Gold Testing, and even Price Matching to guarantee you get the absolute highest payout in Boise.

For expert assistance with your gold, silver, and fine jewelry, trust the team at Carat 24 - Trusted Gold Experts. We provide transparent, professional evaluations to ensure you receive the highest possible payout for your valuables. Visit us at https://carat24boise.com to learn more.