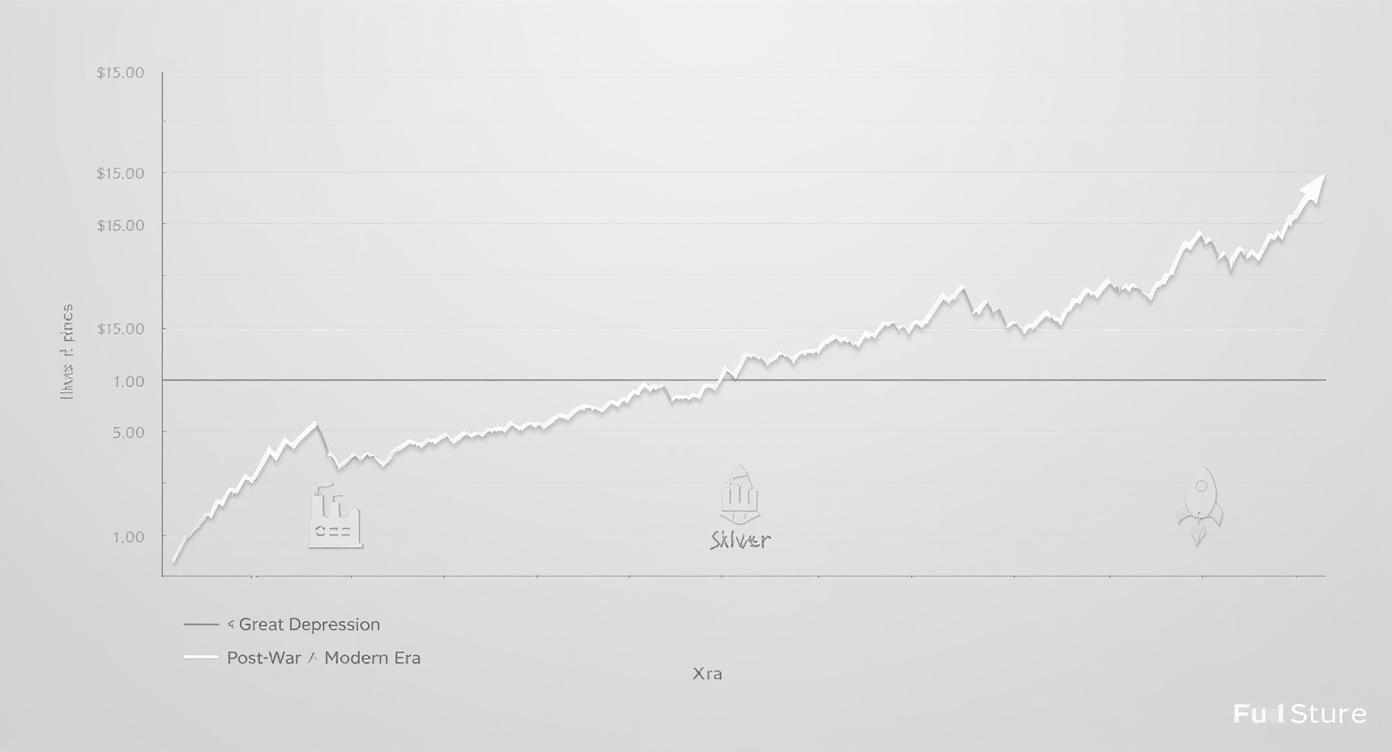

If you look at historical silver prices over 100 years, you'll see a dramatic story of booms and busts. This wild ride has been shaped by everything from global economic crises and industrial breakthroughs to the ever-shifting moods of investors.

Silver's value has swung from a rock-bottom low of just $0.28 per ounce during the depths of the Great Depression all the way up to a staggering peak near $50 per ounce during moments of intense market frenzy. This century-long rollercoaster really shines a light on its dual personality—it's both a critical industrial metal and a trusted haven for wealth.

A Century of Silver Price Movements at a Glance

Silver’s journey through time isn’t just a story about a metal; it’s a direct reflection of our own economic history. Its price chart is like a map marked up with world wars, technological revolutions, and gut-wrenching financial panics.

Understanding these historical price swings provides invaluable context for anyone holding silver assets, whether it's in the form of coins, bullion, or even cherished family jewelry.

What makes silver so interesting—and often volatile—is its dual identity, something it doesn't quite share with gold. While gold is seen almost purely as a monetary asset, silver plays a huge role in industry. When economies are humming along, industrial demand for silver in things like electronics, solar panels, and medical supplies pushes its price higher.

But when the economy sputters or inflation starts to run hot, investors pile into it as a safe-haven asset, which also drives its value up. This tug-of-war is key to understanding its price.

The timeline below gives you a bird's-eye view of silver's dynamic history, charting its course from the Great Depression, through the post-war industrial boom, and into our modern era.

As you can see, major world events line up almost perfectly with big shifts in silver’s value, proving just how tuned-in the metal is to the health of the global economy.

Decade by Decade: Key Drivers and Price Shifts

Digging into silver's past century reveals a pattern directly tied to major economic and geopolitical events. For example, during the Great Depression, prices hit rock bottom, falling to as low as $0.28 per ounce in 1932—a stark reflection of the worldwide turmoil.

After World War II, governments actually kept a tight lid on silver prices. It was just too important for strategic uses in electronics and medicine. This really shifted its valuation towards its industrial utility rather than its monetary role.

To better visualize this journey, here's a breakdown of silver's performance across different historical periods.

Key Eras in Silver Prices Over the Last Century

| Historical Era | Approximate Price Range (per ounce) | Key Economic Drivers |

|---|---|---|

| The Great Depression (1929-1939) | $0.25 - $0.45 | Widespread economic collapse, deflation, and low industrial demand. |

| Post-War Boom (1950s-1960s) | $0.70 - $1.30 | Industrial recovery, removal from U.S. coinage, government price controls. |

| Stagflation & Hunt Brothers (1970s-1980) | $1.50 - $49.45 | High inflation, oil crisis, and massive market manipulation by the Hunt brothers. |

| The Quiet Years (1980s-1990s) | $3.50 - $10.00 | Post-bubble crash, disinflation, steady but unspectacular industrial demand. |

| The Modern Era (2000s-Present) | $4.00 - $48.70 | Financial Crisis of 2008, quantitative easing, rise of ETFs, and green tech demand. |

This table neatly summarizes how silver's value has been pulled in different directions by some of the most powerful forces of the last 100 years.

Whether you're an investor trying to time the market or just thinking about selling some family heirlooms, knowing the history behind the numbers is crucial. For instance, when you're looking to sell silver here in Boise, understanding the current spot price in relation to historical highs and lows can help you feel confident in your decision.

At our Gold and Jewelry Buying center, we make the process easy with transparent, up-to-the-minute offers. We even provide Xray Scanning and Gold Testing for free to ensure you get the highest payout in Boise. By selling locally, you avoid the hassle and risk of shipping your valuables and often get a better price. We'll even price match to make sure you're happy with our hassle free offers.

You can get a better handle on how this all works in our detailed guide on the spot price for gold and silver.

The Great Depression and Post-War Stability

The Roaring Twenties screeched to a halt with the Great Depression, a time that put nearly every asset on the planet to the test. For silver, it was a brutal fall from grace. As the global economy went into a tailspin, industrial production simply stopped, pulling the rug right out from under silver's demand.

This wasn't just a minor dip; it was a total collapse. With deflationary forces squeezing the world economy, silver’s price cratered to an inflation-adjusted, all-time low of just $0.29 per ounce in 1931. It's a stark reminder of just how deeply silver's fate is tied to economic health. When factories go dark, silver feels the pain.

But as the world climbed out of the rubble of World War II, silver's story took a very different turn. The post-war economic boom didn't cause a massive price spike. Instead, governments—especially the United States—saw how strategically important silver was and decided to step in and manage its price directly.

The Shift from Monetary Metal to Industrial Workhorse

This era of rebuilding and technological innovation marked a fundamental change in silver's identity. For centuries, it had been a monetary metal, the stuff of coins and currency backing. Now, its role in industry became its main claim to fame.

Just think about the explosion of new technologies at the time:

- Photography: Silver halide was absolutely essential for making film and photo paper.

- Electronics: Its incredible conductivity made it a key ingredient in everything from radios to the first computers.

- Medicine: Silver's natural antimicrobial properties were being used in new medical treatments and devices.

This ballooning industrial hunger meant governments had a strong reason to keep prices stable. Wild price swings could wreck supply chains for critical defense and consumer goods. So, the U.S. Treasury began selling silver from its own stockpiles to keep the price from rising, effectively putting a lid on the market that would last for years.

This period of government intervention is a crucial chapter in the story of historical silver prices over 100 years. It shows a rare moment when market forces were deliberately held back, prioritizing industrial stability over speculative value. This was the moment silver truly transitioned from a treasure in your pocket to a workhorse in the factory.

The Bretton Woods System and a Period of Calm

The global financial system also helped keep things quiet. The Bretton Woods Agreement of 1944 pegged the U.S. dollar to gold, which in turn anchored other world currencies. While silver wasn't an official part of the system, the overall climate of fixed exchange rates brought a sense of calm to commodity markets.

For almost two decades, silver’s price barely budged, mostly trading in a tight band between $0.90 and $1.29 per ounce. This stability was a world away from the gut-wrenching volatility of the Depression years and a far cry from the explosive moves that were just around the corner. It was a managed market, built for an industrial age.

This history is especially important for anyone holding older coins, as the silver content from this era can make them quite valuable. You can learn more in our detailed article on the value of old silver dollar coins. Knowing the historical context of when a coin was minted is key to understanding what it's worth today.

The Wild Ride of the 1970s and 1980s Silver Boom

After decades of relative quiet and government-managed prices, the silver market was about to get interesting. In fact, it was on the verge of its most chaotic and legendary chapter yet. The 1970s and 1980s unleashed a perfect storm of economic forces that sent silver prices on a rollercoaster, forever cementing its reputation for volatility.

This era is a powerful lesson for today's investors. It shows just how dramatically market psychology, massive speculation, and global events can twist the price of a precious metal, a key part of understanding the historical silver prices over 100 years.

The scene was set by the economic mess of the 1970s. The Bretton Woods system, which had pegged the U.S. dollar to gold, completely fell apart in 1971. This move, combined with an oil crisis and staggering inflation, shredded public faith in paper money.

As people watched the value of their cash evaporate, they looked for a safe place to park their wealth. Gold and silver became the obvious choices, and demand started to climb fast.

The Hunt Brothers and the Dash for Silver

This rising tide of investor anxiety was about to be supercharged by one of the most famous market stories of all time. Enter Nelson Bunker Hunt and William Herbert Hunt, two Texas oil billionaires who were convinced that inflation was going to get much, much worse. They believed silver was the most undervalued asset on the planet.

So, they started buying. And buying. They aggressively snapped up enormous quantities of physical silver bars and futures contracts. Their goal was simple: corner the market. They wanted to own so much silver that they could essentially dictate its price. Their moves created a full-blown speculative frenzy, pulling in countless others who were terrified of missing out.

The Hunt brothers' attempt to corner the silver market is a classic case study in how bubbles form. It's a stark reminder that when concentrated buying power meets widespread economic fear, an asset's price can completely detach from reality, leading to an unsustainable spike.

The pressure they put on the market was immense. Silver, which had been trading for less than $2 per ounce at the start of the decade, began a vertical climb. It felt like a one-way bet, with prices rocketing up as the Hunts tightened their chokehold on the world's supply.

The Peak and the Inevitable Crash

The whole thing blew up in early 1980. The silver boom reached its absolute peak, with prices soaring to an incredible $36 per ounce. It was a staggering rise fueled by speculation and deep-seated fears about inflation.

But what goes up that fast, must come down. The crash was just as spectacular. Regulators and commodity exchanges, worried about the integrity of the market, stepped in. They changed the trading rules specifically to stop the speculation, a move that pulled the rug out from under the Hunts.

This day became known as "Silver Thursday." The Hunt brothers couldn't meet their margin calls, triggering a tidal wave of selling.

The bubble didn't just leak; it exploded. The price of silver cratered, dropping over 50% in a single day. By the end of the decade, silver was back under $10 per ounce. The speculative fever dream was over, leaving many investors ruined and kicking off a long bear market that would last for nearly two decades. You can dig into the specifics of these market events by exploring the comprehensive history of silver's price movements on SilverPrice.org.

This chaotic period is a critical chapter for anyone involved in Gold and Jewelry Buying, as it perfectly illustrates the extreme risks of trying to time the market.

For folks here in Boise looking to sell precious metals, this history is invaluable. It’s a powerful reminder of why getting a fair, transparent evaluation is so critical. We offer hassle free offers and guarantee the highest payout in Boise with our Price Matching policy. Our free Xray Scanning and Gold Testing services take the guesswork out of the equation, confirming your items' true value. When you save the hassle and sell locally for more than online shipments, you’re not just getting a better return—you’re getting peace of mind.

Silver in the Modern Technological Age

As the world turned the page into the 21st century, a new chapter began for silver. The relatively quiet 1990s gave way to a reawakening, as silver started flexing its muscles, driven by a potent mix of investment demand and its growing importance in cutting-edge technology. This new era would see the metal climb to heights not witnessed since the speculative mania of 1980, but this time, the story was very different.

The new millennium brought with it a renewed fascination with silver as a hard asset. After the dot-com bubble burst, leaving a trail of economic uncertainty, investors started looking for tangible stores of value again. This slow-burning interest was just setting the stage for one of the most explosive price runs in modern history.

The 2008 Financial Crisis and Silver’s Safe-Haven Rally

The 2008 global financial crisis was a defining moment for precious metals. As massive financial institutions teetered on the brink of collapse and panic seized the markets, investors made a mad dash for safety. In response, central banks, spearheaded by the U.S. Federal Reserve, unleashed unprecedented monetary stimulus programs, famously known as quantitative easing (QE).

This deluge of newly printed money effectively devalued currencies and sparked legitimate fears of future inflation. In this chaotic environment, silver and gold shone like beacons. Investors piled in, looking to shield their wealth from the storm. Silver, being the more affordable of the two, attracted a huge wave of both retail and institutional money, launching its price from under $9 per ounce to over $20.

This period was a textbook example of silver’s power as a monetary hedge. The rally didn't stop there; fueled by ongoing QE measures and investor anxiety, silver prices rocketed to a peak of nearly $48.70 per ounce in 2011. More recently, its essential role in green technology and electronics has provided a solid floor for its price. This modern surge underscores silver's status not just as money, but as a critical component in the technologies shaping our future.

Silver’s Expanding Industrial Importance

While the "safe-haven" story grabbed all the headlines, another powerful force was quietly at work behind the scenes. Throughout the 21st century, silver has become an absolutely essential ingredient in modern technology. Its unique properties—namely, its unmatched electrical and thermal conductivity—make it irreplaceable in a growing number of high-tech applications.

This industrial demand is what truly sets silver apart from gold, giving its value a strong, practical foundation. Just look at where it's being used:

- Solar Panels: Silver paste is a critical element in the photovoltaic cells that turn sunlight into power. The global push toward renewable energy has created a massive, and still growing, appetite for silver.

- Electric Vehicles (EVs): An EV uses far more silver than a standard gas-powered car. You'll find it everywhere from battery packs to the countless electrical contacts needed to make the vehicle run.

- Consumer Electronics: Every single smartphone, laptop, and tablet you own contains a small but vital amount of silver in its intricate circuitry.

This blend of monetary appeal and industrial necessity creates a powerful and unique dynamic for silver's price. Unlike in decades past, its value is now supported by two incredibly strong pillars. For anyone holding different forms of silver, it's useful to know what goes into their weight and value. You can learn more about how much silver bars weigh in our detailed guide.

Silver's modern identity is a fascinating paradox. It is simultaneously an ancient store of wealth sought during financial chaos and a futuristic metal powering the green energy revolution. This dual role is the primary engine behind its price movements in the 21st century.

Knowing this history is especially valuable when it comes to Gold and Jewelry Buying. If you're in the Boise area and considering selling silver jewelry or bullion, understanding these long-term price drivers helps you recognize its true worth. We make sure you get the highest payout in Boise by providing hassle free offers and a Price Matching guarantee. Our process even includes free Xray Scanning and Gold Testing for total transparency. You can save the hassle and sell locally for more than online shipments, guaranteeing a secure and profitable experience.

How to Get the Highest Payout for Your Silver in Boise

So, you've just read through the epic story of silver's journey over the last century. It's more than just an interesting history lesson—it's a practical guide for anyone holding silver, whether it's grandma's old jewelry, a jar of coins, or investment bars. The wild booms and busts we've seen show one thing clearly: timing and trust are everything when it's time to sell.

This historical backdrop gives you the power to see the real, underlying value in what you own. When you understand how silver has held its ground through inflation, global crises, and massive technological shifts, you realize you're not just holding metal. You're holding a genuine store of value. This knowledge empowers you to demand a fair deal and ensures you walk away with the maximum return.

Why Selling Locally in Boise Beats Online Mail-In Services

Online mail-in services might seem convenient, but they often come with hidden catches and lower payouts. You ship your precious metals into the void, hoping for a fair offer, in a process that can be slow, confusing, and frankly, a little nerve-wracking. This is where selling locally shines.

When you sell to a trusted Boise buyer in person, you save the hassle and sell locally for more than online shipments. Everything is immediate and out in the open. You're right there for the evaluation, you can ask questions face-to-face, and you get paid right on the spot.

Choosing a trusted local buyer isn’t just about getting cash fast; it’s about security and value. You completely avoid the risk of your items getting lost or damaged in shipping and gain the peace of mind that comes with a direct, personal transaction.

This face-to-face interaction puts you firmly in control. Local experts know the market inside and out and are invested in building a solid reputation in the community, which almost always means better, more reliable offers for you.

The Power of Transparency: Free X-Ray Scanning

Getting the best price starts with knowing exactly what you have. That's where modern technology makes all the difference. Reputable local buyers in Boise use advanced testing methods to verify the exact purity of your gold and silver.

Here, we provide Xray Scanning and Gold Testing for free. We use a non-invasive technology called X-ray fluorescence (XRF) that gives us a precise reading of your item's precious metal content without leaving a single mark.

This service delivers a few key things:

- Complete Accuracy: You get a precise measurement of your silver's purity, so the offer is based on its true melt value. No guesswork.

- Total Transparency: We invite you to watch the entire process, which removes any doubt about what your items are really worth.

- Peace of Mind: When you know the exact composition of what you own, you can make a selling decision with total confidence.

This commitment to clarity is how we can make hassle free offers. When the value is crystal clear, the offer is simple and straightforward.

Securing the Highest Payout in Boise—Guaranteed

At the end of the day, you want to get the most money possible for your valuables. A trustworthy local buyer should be confident enough to stand behind their offers. That’s why we are committed to providing the highest payout in Boise.

To make sure you always walk away with the best deal, we have a Price Matching guarantee. If you bring us a better written offer from another local competitor, we’ll match it. This policy means you don't have to spend your time shopping around—you can be certain you're getting a top-dollar return right here.

Whether you're selling a single silver eagle or a whole box of jewelry, understanding the process is key. For more tips on turning your precious metals into cash, take a look at our guide on how to sell a bar of silver; many of the tips in it apply to all kinds of silver.

Frequently Asked Questions About Silver’s Value

After a century-long look at silver’s ups and downs, it’s natural to have a few lingering questions. Below, you’ll find clear, actionable answers to the queries we hear most often.

Why Are Silver Prices More Volatile Than Gold Prices

Silver’s price swings feel almost theatrical next to gold’s steadier climb. One big reason? Roughly 50% of all silver is snapped up by industry—think electronics, solar panels, and medical tools.

- Industrial Dependence: When factories ramp up, prices rise; when they slow, silver often dips.

- Market Size: A smaller market means even modest trades can trigger major moves.

- Dual Role: As both an industrial metal and a store of value, silver reacts to economic trends and manufacturing shifts.

This unique blend of factors makes silver’s chart look more like a roller coaster than gold’s gentle hill.

How Does Industrial Demand Affect Historical Silver Prices

Picture silver as part currency, part raw material. Every technological leap—from early photography to today’s green energy revolution—has left its mark on silver’s price.

During boom years, factories scramble for enough silver, driving prices up. In downturns, demand falls, and silver can slide.

The consistent, and growing, industrial consumption of silver is a key element in the story of historical silver prices 100 years. It provides a fundamental price floor that pure monetary assets like gold do not have, making its valuation a unique blend of factory floor demand and investor sentiment.

What Can 100 Years Of Prices Tell Me About Selling My Silver Jewelry

If you’ve held silver jewelry through market storms, history shows it often outperforms during turbulence. Silver acts as a solid hedge when inflation bites or currencies weaken.

Here are a few practical takeaways:

- Timing Insights: Compare today’s spot price with past peaks and troughs to choose the right selling moment.

- Transparent Valuation: Insist on precise metal-content assessments to avoid surprises.

- Local Advantage: Selling in Boise usually nets you more than shipping items far away.

For deeper guidance, check our detailed guide on what pawn shops might offer for silver. Partner with a local expert who offers Xray Scanning and Gold Testing for Free to ensure the highest payout in Boise.

Is Silver Still Considered A Safe-Haven Asset Like Gold

Absolutely. When inflation surges or markets wobble, investors seek out both silver and gold. The dramatic spikes in 1980 and 2011 are perfect examples of this flight to safety.

That industrial side can cut two ways, though—severe downturns may curb factory orders and temper price gains. Still, silver’s lower entry point—often called “poor man’s gold”—makes it accessible for anyone looking to protect their wealth.

- Affordability: You don’t need a fortune to own a piece of tangible security.

- Protective Power: Silver shares many of gold’s benefits at a fraction of the cost.

- Buyer Guarantees: Seek out hassle-free offers and price matching to get the fairest deal.

At Carat 24 - Trusted Gold Experts, we combine decades of market insight with state-of-the-art testing to deliver the best possible payout for your precious metals. Visit us in Boise for a professional, rewarding selling experience. Learn more at https://carat24boise.com.