If you've ever wondered how gold and silver are valued, the conversation always starts with one key term: the spot price.

Think of the spot price of gold and silver as the live, wholesale cost for one ounce of pure metal, ready for immediate delivery. This is the price you see scrolling across the bottom of financial news channels—the baseline number traders use on global exchanges. It’s the foundational benchmark that every precious metal product, from a massive gold bar to a small silver earring, is valued against. When it comes to Gold and Jewelry Buying, understanding the spot price is the first step to getting the highest payout in Boise.

The Foundation: What Is The Spot Price?

Here's a simple analogy: imagine the spot price is the wholesale cost of raw lumber straight from the mill. A furniture maker doesn't sell a finished dining room table for the price of that raw wood. They have to account for their craftsmanship, the design, transportation, and their own business costs.

In the same way, the cash offer you receive for your gold jewelry or silver coins will start with the spot price, but it won't be identical. The live spot price is the core of every transaction in the precious metals world, but other factors come into play before you get your final payout. This price is constantly shifting based on global supply and demand, economic news, and investor sentiment.

Spot Price Vs. Payout: A Quick Comparison

It's crucial to understand the difference between the global market benchmark (spot price) and the actual cash offer you'll receive (your payout). This table breaks it down clearly.

| Characteristic | Spot Price (The Benchmark) | Your Payout (The Offer) |

|---|---|---|

| What It Represents | The live wholesale market price for one troy ounce of pure (.999 fine) metal. | The cash value offered for your specific item, after accounting for purity, weight, and dealer costs. |

| Who Uses It | Large-scale commodity traders, banks, and financial institutions on global exchanges. | Local gold buyers, jewelers, and refiners who buy items from the public. |

| Purity Basis | Always based on 24-karat gold or .999 fine silver. | Calculated based on your item's actual purity (e.g., 10k, 14k, 18k gold). |

| Form Factor | Refers to large, unrefined bullion bars (e.g., 400 oz gold bars). | Applies to finished goods like jewelry, coins, and scrap metal. |

| Key Takeaway | A universal, real-time benchmark for raw metal. | A practical, real-world cash offer derived from the spot price. |

Understanding this distinction is the first step toward feeling confident and getting a fair deal when you sell.

The Bridge Between Global Markets And Your Payout

For anyone considering selling gold and jewelry in Boise, knowing about the spot price is your first step toward a fair and transparent transaction. The spot price is a universal number, but how a buyer translates that number into a cash offer for your specific items is what really matters.

This is where having a trusted local expert makes all the difference. At Carat 24, we don't just give you a number—we show you the entire process, connecting the dots between the global market and your personal payout.

Here’s how we do it:

- Free X-Ray Scans: We use state-of-the-art Xray Scanning to determine the exact metal content of your items, completely free and with zero damage.

- Transparent Gold Testing: We perform all Gold Testing for free right in front of you, explaining every step so you know exactly what you have.

- Hassle free offers: Our payouts are based directly on the live spot prices, ensuring you get a fair and competitive valuation every single time.

Knowing the spot price empowers you as a seller. It transforms a potentially confusing process into a transparent one, where you can see exactly how your item’s value is calculated based on a global standard.

Spot Price As A Reliable Benchmark

History shows that gold is a reliable store of value. Looking at the data from 1978 to 2025, gold's spot price posted positive returns in 28 of those 47 years—that's a 60% success rate. We see this strength during periods of economic uncertainty, too. For instance, the annual average price climbed from $1,393.86 in 2019 to $1,771.07 in 2020.

When you sell locally, you avoid the risks and hassles of shipping your valuables and can often secure a better price. We are committed to offering the highest payout in Boise, and we even offer Price Matching to back that up. Save the hassle and sell locally for more than online shipments. You can also explore our guide on the troy ounce to better understand how precious metals are weighed and valued.

How Global Markets Set The Spot Price

The spot price of gold and silver doesn’t just materialize out of thin air. Think of it as a massive, non-stop global auction, happening 24/7 across the world's major commodity exchanges. The most influential of these is the COMEX in New York.

On these exchanges, traders aren't usually swapping giant bars of physical metal. Instead, they're trading futures contracts—agreements to buy or sell a specific amount of gold or silver at a set price on a future date. The price of the most actively traded contract is what essentially becomes the live spot price you see online. It's a lightning-fast system where billions of dollars change hands, creating a single global benchmark.

This constant auction involves some seriously big players, and their moves can cause ripples that affect the value of the items right in your jewelry box. A political flare-up halfway across the globe can literally change the value of your heirlooms overnight. Understanding these forces is key to figuring out the best time to sell.

The Key Players In The Global Auction

The precious metals market is driven by a few major groups whose buying and selling activities directly steer the daily spot price. Each has different motivations, but together, their actions create the market we see.

- Central Banks: These are the big kahunas. National governments buy and hold enormous amounts of gold as part of their financial reserves. When they make a large-scale purchase, it can seriously boost demand and push prices higher.

- Investors: This group ranges from huge hedge funds to everyday people buying into gold-backed ETFs. They turn to gold and silver as a safe haven to protect their wealth, especially when the economy looks shaky.

- Industrial Users: Precious metals aren't just for investing or jewelry. Silver, in particular, is a crucial component in everything from solar panels and electronics to medical devices. High industrial demand can put real upward pressure on its price.

- Gold and Jewelry Buying Industry: This is our world. Jewelers, refiners, and gold buyers are constantly in the market, buying metal to create new pieces and recycling old items. This steady demand provides a solid foundation for the market.

When you see the spot price tick up or down, you're watching a live tug-of-war between these global forces. It’s exactly why getting an offer based on a transparent, live price is so critical to getting a fair deal.

Here at Carat 24, we anchor our offers to these live, up-to-the-minute market prices—no games, no hassle. This commitment ensures that when you come to us for Gold and Jewelry Buying in Boise, you're getting a payout that reflects the metal’s true global worth at that exact moment. You can dive deeper into what affects gold prices in our detailed guide.

Our goal is to make it easy for you to save the hassle and sell locally for more than online shipments. We back that up with our promise of the highest payout in Boise, free Xray Scanning, and a rock-solid Price Matching guarantee.

The Real Forces That Move Gold And Silver Prices

Ever watch the news and wonder why the spot price of gold and silver suddenly jumped? It’s not random. Those shifts are direct reactions to powerful global forces, and understanding what drives them is the key to spotting a good opportunity.

Think of precious metals as a financial barometer. When the economic forecast looks stormy, people don't just get nervous—they run to assets that have held their value for centuries. This is the "safe haven" effect in action, and it’s one of the most powerful market drivers out there.

Economic Fear And The Flight To Safety

When inflation starts eating away at your savings, the cash in your bank account buys less and less. When the stock market gets choppy, investors start sweating over their portfolios. In times like these, gold and silver suddenly look incredibly attractive.

Why? Because they're real, tangible assets. You can't print more of them, and they have a long, proven history of preserving wealth when paper assets fail. This flood of demand from nervous investors is what can send the spot price soaring, often in a hurry. For a Boise resident looking at their jewelry collection, this is a critical signal to watch.

An environment of economic uncertainty often creates the best opportunities for sellers. As demand for safe-haven assets like gold soars, the potential payout for your items increases right along with it.

Just imagine watching gold’s spot price hit an all-time high of $5,608.35 per troy ounce back in January 2026. That peak wasn't just a number on a screen; it was a massive 82.88% surge from the year before, all because global economic jitters turned gold into the ultimate safe-haven asset. For folks in Boise holding onto estate jewelry, a moment like that is a prime selling opportunity. You can explore more historical price trends and data over on Trading Economics.

The Dollar's Power And Interest Rates

The dance between precious metals and the U.S. dollar is another huge piece of the puzzle. Since gold and silver are priced in dollars all over the world, they have an inverse relationship that’s actually pretty simple to grasp.

- When the Dollar is Weak: It takes more dollars to buy an ounce of gold. This typically pushes the spot price of gold higher.

- When the Dollar is Strong: It takes fewer dollars to buy that same ounce, which can put downward pressure on the spot price.

Interest rates have a similar effect. Gold and silver don't pay interest or dividends, so they have to compete with assets that do, like bonds. When interest rates are high, holding a non-yielding metal like gold can seem less appealing to big investors, which might soften demand. On the flip side, when interest rates are low, gold becomes a much more attractive place to park your money.

Global Conflict And Geopolitical Tension

Nothing sends a jolt through the precious metals market faster than geopolitical instability. When conflicts flare up or international tensions escalate, uncertainty rips through the global economy. Investors immediately look for solid ground, and gold has always been the ultimate crisis commodity.

This isn't just about Wall Street traders; it's a gut-level human reaction to chaos. For anyone considering Gold and Jewelry Buying options, these world events directly and immediately impact the value of what you own. A sudden spike in the spot price because of something happening overseas could be the perfect signal that it’s time to talk to a local expert.

At Carat 24, we offer free Xray Scanning and Gold Testing for free so you know the exact value of your items based on these live market movements. We give you hassle free offers with a Price Matching guarantee, making sure you always get the highest payout in Boise. You can skip the risk and headache of shipping your valuables online and sell locally for more, turning market volatility into a real reward.

How To Calculate Your Gold's Payout Value

Turning that old piece of jewelry into cash isn't magic—it's a straightforward, three-step calculation. This is where the global spot price of gold and silver connects with the items in your hands, giving you the power to estimate their value before you even step through our doors.

First things first: you need to know the purity of your gold. Jewelry is almost never made from pure 24-karat gold because it's simply too soft for everyday wear. Instead, it’s mixed with other, stronger metals for durability. The "karat" stamp tells you exactly how much pure gold is in that mix.

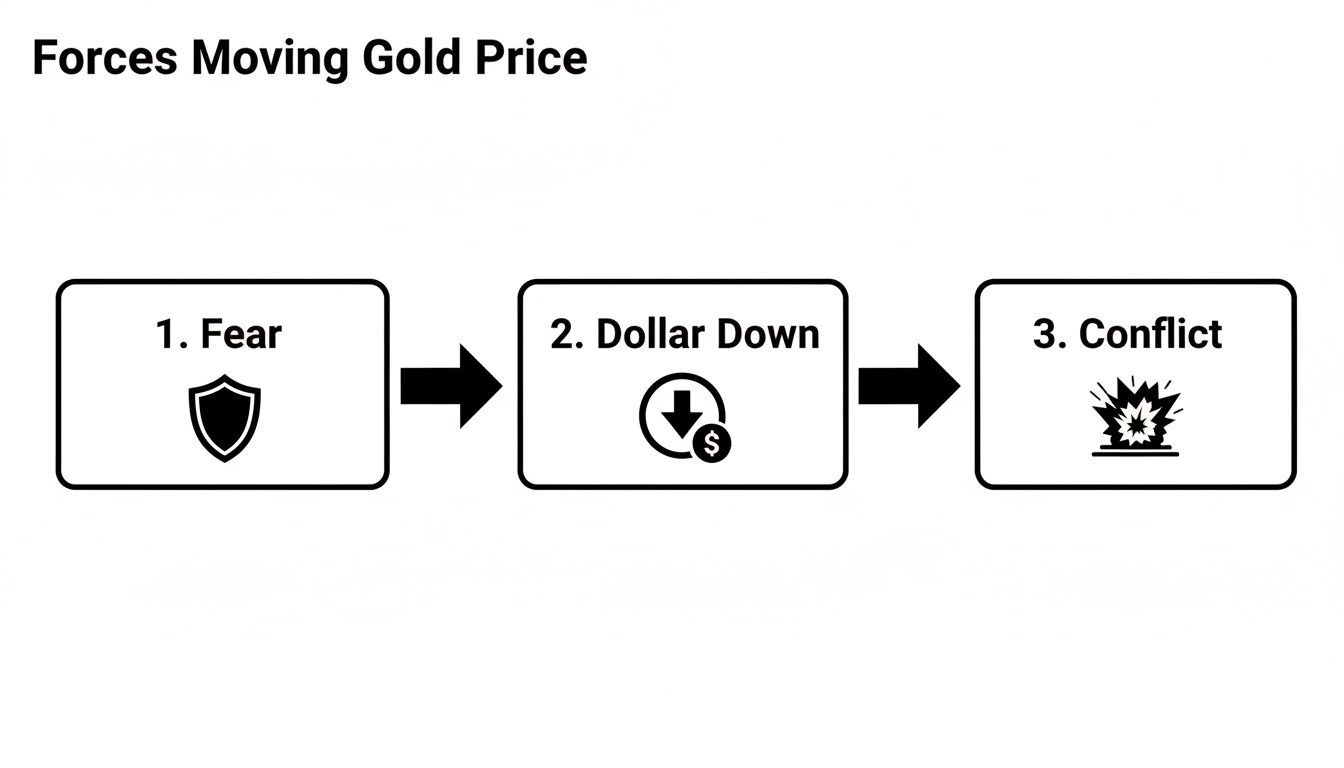

The live price you'll use for your calculation is influenced by some major global forces.

As you can see, things like economic fear, the strength of the dollar, and global conflict have a direct impact on the daily spot price, which serves as the starting point for your payout.

The Karat Purity Factor

The karat stamp on your jewelry is the key to its value. Think of it like a recipe—it tells you the exact percentage of pure gold compared to the other alloys in the piece.

Here’s a look at the most common purities you're likely to find:

- 10K Gold: Contains 41.7% pure gold. It's a tough, affordable option you'll often see in rings and chains meant for daily wear.

- 14K Gold: Contains 58.3% pure gold. This is the sweet spot for fine jewelry in the U.S., offering a perfect balance of beautiful color and durability.

- 18K Gold: Contains 75% pure gold. Popular in high-end European jewelry, it boasts a much richer, deeper yellow hue.

- 24K Gold: This is 99.9% pure gold. You’ll rarely find it in jewelry; it's typically reserved for investment-grade bullion bars and coins.

The table below breaks down exactly how the karat stamp on your jewelry translates to its actual gold content and, ultimately, its value.

Understanding Gold Karat And Purity

See how the karat stamp on your jewelry directly relates to its pure gold content and final payout value.

| Karat (Purity) | Pure Gold Content | Impact On Value |

|---|---|---|

| 10K | 41.7% | The starting point for fine jewelry, offering durability over high gold content. |

| 14K | 58.3% | The most popular purity in the U.S., providing a great balance of value and strength. |

| 18K | 75.0% | A significant step up in value with a rich, deep color due to high gold content. |

| 24K | 99.9% | The highest possible purity, representing the full spot market value of pure gold. |

Understanding these percentages is the first step to knowing what you have.

Here at Carat 24 in Boise, we take the guesswork out of it. We offer free Xray Scanning to instantly verify the exact purity of your items. This professional Gold Testing for free ensures you know precisely what you're selling, which is the foundation for a fair, transparent, and completely hassle free offer.

Weight And The Live Spot Price

Next up, you need the item's weight. For the best accuracy, use a precise digital scale. Once you have the weight and purity, you can combine it with the current spot price of gold and silver.

The basic formula looks like this:

- Find the live spot price for one troy ounce of gold.

- Multiply that price by the purity percentage of your item (for example, 0.583 for 14K). This gives you the value of one troy ounce of your specific alloy.

- Divide that number by 31.1 (the number of grams in a troy ounce) to find the price per gram.

- Multiply the per-gram price by the weight of your item in grams.

Voilà! That final number is the raw "melt value" of your piece. If you'd like to explore this more, check out our guide that answers the question, "How much is an ounce of gold worth?".

From Melt Value To A Top-Dollar Offer

The final offer you get from a buyer will be a bit different from the raw melt value you just calculated. That’s because any business specializing in Gold and Jewelry Buying has to factor in real-world costs like refining, assaying, and operations.

A trustworthy buyer is always transparent about this part. They use the live spot price as the foundation and then apply a fair percentage to cover their costs, which results in your final cash payout. Our commitment is simple: to offer the highest payout in Boise, and we even back it up with a Price Match guarantee.

Remember, if you sell gold or silver for a profit, knowing how to figure capital gains is important for understanding your true net gain. When you choose to save the hassle and sell locally for more than online shipments, you're getting a secure, instant payment from a trusted partner in your community.

Why Selling Locally In Boise Is Smarter Than Shipping

When it's time to sell your valuables, you hit a fork in the road: do you ship them off to a faceless online buyer, or do you work with a trusted local expert right here in town? Mail-in services might dangle the carrot of convenience, but the risks can easily sour the deal, often leading to lower payouts and a whole lot of unnecessary stress.

Think about it. Shipping your precious metals across the country means you lose all control. You pack your items, send them off into the unknown, and just... wait. You're left hoping for a fair assessment from a company you've never met, run by people you'll never see. That whole process is a gamble. Will it get there safely? Will their offer even come close to the real spot price of gold and silver? And what happens if you don't like their number? Getting your items back can be a slow, frustrating nightmare.

The Power Of In-Person Transparency

Choosing to save the hassle and sell locally for more than online shipments puts you back in the driver's seat. Here at Carat 24, we believe the entire process should be an open book. Instead of wondering what’s happening behind some closed door hundreds of miles away, you’re a part of every single step.

- See It For Yourself: You can stand right here and watch as we use our free Xray Scanning and Gold Testing for free to analyze your pieces. We'll explain what we're seeing, show you the purity results, and answer any questions you have, right on the spot.

- Instant Payment: Forget waiting for a check to crawl through the mail or a bank transfer to clear. The moment you accept our offer, you walk out of our store with payment in your hand. It’s that simple.

- Hassle free offers: We give you a straightforward, no-pressure valuation based on the live market prices. You can take it or leave it, with absolutely no obligation.

This direct, secure, and transparent approach simply removes all the anxiety and guesswork that comes with those mail-in services.

By dealing with a local business, you're partnering with professionals who are invested in their community reputation. We’re not an anonymous website; we’re your Boise neighbors committed to fair and honest Gold and Jewelry Buying.

Get The Highest Payout Guaranteed

Beyond just the security and transparency, selling locally often flat-out gets you a better price. National online companies have massive marketing budgets and shipping overhead to cover. Guess who pays for that? Those costs are often passed down to you in the form of lower offers.

As a local business, our model is built on efficiency and volume, which lets us offer more for your items. We're so confident we provide the best value that we guarantee the highest payout in Boise.

We even offer Price Matching. If you get a better written offer from another local competitor, bring it in, and we'll match it. You can learn more about picking the right buyer in our guide on the best place to sell gold. Save the hassle and the uncertainty—choose the trusted local experts at Carat 24 for a secure, transparent, and more profitable experience.

Common Questions About Selling Gold And Silver

To wrap things up, let's go through some of the most common questions people have when they're thinking about selling their gold and silver. This quick FAQ is designed to give you straightforward answers so you can move forward with total confidence.

Is The Spot Price The Exact Amount I Get For My Jewelry?

Not exactly, and this is probably the most important thing to get straight. The spot price of gold and silver you see on the news applies to pure, 24-karat metal being traded in massive quantities, usually in the form of large bars.

Think of the spot price as the starting point. From there, the payout for your specific item is adjusted based on its purity (like 14K or 18K) and a small margin that covers the costs of refining the metal and running a business. At Carat 24, we keep this process completely transparent. We guarantee the highest payout in Boise by keeping our margins fair, which means more cash in your pocket.

How Can I Check The Live Spot Price Myself?

It’s actually pretty easy. You can find live charts on financial news sites like Kitco or Bloomberg. But honestly, you don't need to become a market analyst just to get a fair deal.

When you come into our Boise store, we pull up the live, up-to-the-minute spot price right in front of you. It's the same price we use to calculate your hassle free offer. This way, you can see exactly how we got to your number, knowing it's based on real-time market data.

The goal isn't just to sell your items; it's to sell them feeling confident you got a fair and honest price. A trusted local buyer will always be happy to show you the numbers they're using.

Why Is My Silver Worth So Much Less Than Gold Of The Same Weight?

This really boils down to two things: how rare it is and how much it’s in demand. Gold is just fundamentally rarer in the earth's crust than silver. On top of that, gold has a long history of being the main reserve asset for central banks all over the world, which keeps its spot price much, much higher.

Even with the big value difference, we handle both metals with the same transparent approach. We'll value every piece based on its own live spot price and walk you through the payout for each item you bring in. If you want to dive deeper into how we figure out the value, check out our article on "what is my gold worth".

Should I Sell Now Or Wait For A Higher Price?

Trying to perfectly time the precious metals market is something even seasoned professionals struggle with—it's nearly impossible. The best time to sell is simply when you feel ready and the offer you receive feels right for your needs.

Our job is to help you make that call without any pressure. We provide a totally free, no-obligation evaluation using our precise Xray Scanning and Gold Testing for free. You'll get a firm, top-dollar offer from a trusted Boise expert based on that day's market, empowering you to decide what's best. Plus, you can save the hassle and sell locally for more than online shipments with an expert who has a Price Matching guarantee.

Ready to discover the true value of your items with a trusted local expert? Visit us at Carat 24 - Trusted Gold Experts for a free, transparent evaluation and receive the highest payout in Boise, guaranteed. https://carat24boise.com