If you've ever dug through a jar of old change, you might be sitting on more than just a few dollars. The real treasure lies in dimes minted before 1965. It takes about 14 of these old silver dimes to equal one troy ounce of pure silver, making them far more valuable than their ten-cent face value.

Understanding Silver Dimes and Ounces

The key is knowing what to look for. Dimes minted after 1964 are just copper and nickel sandwiches with no silver content. The ones you want are dated 1964 or earlier—those are the coins made with 90% silver, making them highly sought after by both investors and collectors.

But there's another crucial detail many people miss: how we measure precious metals. When you're talking about silver or gold, the industry standard is the troy ounce, not the common "avoirdupois" ounce we use for weighing things like food at the grocery store.

A troy ounce is a bit heavier, which is a critical distinction when you're calculating the value of your stack. To get a better handle on this, check out our guide explaining exactly what a troy ounce is. This difference is precisely why the math matters when figuring out how many silver dimes truly make an ounce.

Dimes Per Ounce at a Glance

For a quick reference, here's a simple breakdown of how many 90% silver dimes you'll need for each type of ounce.

| Unit of Measurement | Dimes Required (Approximate) |

|---|---|

| Troy Ounce | 14 Dimes |

| Avoirdupois (Standard) Ounce | 13 Dimes |

This table gives you a great starting point, but let's dive into the exact numbers.

The Math Behind the Metal

To be perfectly precise, a pre-1965 Roosevelt dime contains 0.07234 troy ounces of pure silver. If you do the math, that means you need exactly 13.82 dimes to hit one full troy ounce.

Of course, you can't have a fraction of a coin, so in the real world, this is why the number is almost always rounded up to 14 dimes to make a troy ounce.

Knowing this is the first step toward understanding the true value of what you have. Whether you've got a handful of silver dimes, other old coins, or are interested in gold and jewelry buying, getting an accurate assessment is everything. Here at our Boise location, we offer straightforward, hassle-free offers with free Xray scanning and gold testing to find the real value of your items. We guarantee the highest payout in Boise and will even price match. You can save the hassle and sell locally for more than online shipments.

Why Your Old Dimes Are Made of Silver

What makes a dime from 1964 so different from one minted just a year later? The answer lies in its precious metal content—a fascinating legacy of American economic history that turns old pocket change into a real, tangible asset.

For decades, the U.S. government produced dimes, quarters, and half-dollars with a 90% silver and 10% copper composition. This wasn't just for looks; it provided the country with durable currency that had intrinsic value tied directly to the price of silver. A dime wasn't just worth ten cents; it was worth its weight in a precious metal, a standard that instilled massive public confidence in the currency.

The U.S. dime's journey with silver started all the way back with the Coinage Act of 1792. Over the years, its composition was tweaked, eventually settling on the 90% silver alloy that collectors and investors hunt for today. This silver standard for dimes ran right up until 1964.

The End of an Era: The Coinage Act of 1965

By the early 1960s, the economic landscape had shifted dramatically. The global price of silver was climbing, and pretty soon, the melt value of these coins was higher than their face value. This created a huge problem. People started hoarding silver coins instead of spending them, which led to a nationwide coin shortage.

Congress had to act. Their response was the Coinage Act of 1965, a landmark piece of legislation that completely removed silver from dimes and quarters. It replaced the precious metal with the copper-nickel clad composition that our coins still have today.

This single act instantly turned every pre-1965 dime into a historical artifact and a small piece of silver bullion. For a closer look at a specific example, you can delve into the historical context and specifications of the 1946 Roosevelt Dime.

This historical shift is exactly why your grandparents' old coin jar could be so valuable. Each silver dime, whether it’s a Roosevelt or an older Mercury design, is a small piece of investment-grade silver.

This rich history adds a layer of fascination to gold and jewelry buying. When you bring us your old coins, you're not just selling metal. We offer the highest payout in Boise because we understand this value, providing free Xray scanning and gold testing to ensure you get a transparent, hassle-free offer. You can save the hassle of online shipments and sell locally for more.

How Much Is All That Silver Really Worth?

If you're holding onto old dimes, you know they're worth more than ten cents. But their true value isn't about the date stamped on them—it's tied directly to the silver inside. This is what we in the industry call "melt value," and knowing how to figure it out is the first step to understanding what your collection is actually worth.

Thankfully, the math isn't too complicated. It all starts with knowing that each pre-1965 dime contains 0.0723 troy ounces of pure silver. From there, you just need to multiply that by the current price of silver, also known as the spot price.

Melt Value = (Number of Dimes x 0.0723) x Current Silver Spot Price

Let's run a quick example. Say you've got a jar with 100 of these old silver dimes. You're holding about 7.23 troy ounces of pure silver. If silver's spot price is sitting at $30 per ounce, your dimes have a melt value of roughly $216.90. You can always get the latest numbers by checking the current spot price for gold and silver.

From Math to the Real World

In the practical world of precious metals, these dimes are surprisingly useful. While the exact calculation shows it takes about 13.8 dimes to make a troy ounce, the standard practice in the community is to round up. Fourteen circulated dimes are widely accepted as one ounce of silver, which makes them perfect for smaller transactions or bartering without having to slice up a big silver bar.

Of course, knowing your silver is key. To get a solid handle on your dimes' value, it helps to understand various silver purities, like the difference between sterling silver and pure silver. A little bit of knowledge goes a long way.

This simple calculation puts the power back in your hands. Before you even think about selling, you can walk in with a strong estimate of what you have, giving you confidence and control over the whole process.

When you're ready to sell, nothing beats an expert, in-person evaluation. We specialize in gold and jewelry buying and are known for offering the highest payout in Boise. We use free Xray scanning and gold testing to give you a transparent, no-pressure, hassle-free offer. You can save the hassle and sell locally for more than online shipments, all backed by our price matching guarantee.

Melt Value vs. Collector Value: What’s Your Dime Really Worth?

Figuring out how many silver dimes it takes to make an ounce is a great first step, but it only tells part of the story. The truth is, not every old dime is destined for the melting pot. This is where you run into the crucial difference between melt value and what we call collector value, or numismatic value.

For the most part, the common pre-1965 Roosevelt dimes you find are valued almost entirely for the silver they contain. They made millions of them, so their worth is directly tied to the daily price of silver. Simple enough.

But every so often, you stumble upon a dime that’s worth far more to a collector than it is to a refiner. This happens when a coin is rare, has a minting error, or is in spectacular, almost perfect condition. These are the "key date" coins collectors hunt for. A standard 1964-D Roosevelt dime is a perfect example of a melt-value coin. But a rare 1916-D Mercury dime? In good shape, that could be worth hundreds, even thousands—way beyond what its tiny bit of silver is worth. You can dive deeper into what makes certain coins stand out in our guide on what are numismatic coins.

Is It Just Silver, or Something More?

Before you lump all your old dimes into a "junk silver" pile, it pays to do a quick check. You might be holding something special. Here's what to look for:

- Check the Date and Mint Mark: Certain years had very low production numbers. The 1949-S Roosevelt dime is a great example. Also, look for the tiny mint mark letter ('S' for San Francisco, 'D' for Denver, 'W' for West Point). That little letter can be the difference between a common coin and a rare one.

- Assess the Condition: A coin that looks like it just left the mint—we call this "uncirculated"—will almost always fetch a higher price than one that’s been rattling around in pockets for decades.

- Look for Errors: Mistakes happen, even at the U.S. Mint. Things like a doubled date or a design that was struck off-center create error coins, and collectors go nuts for them.

This quick check is the first step to figuring out what you've really got.

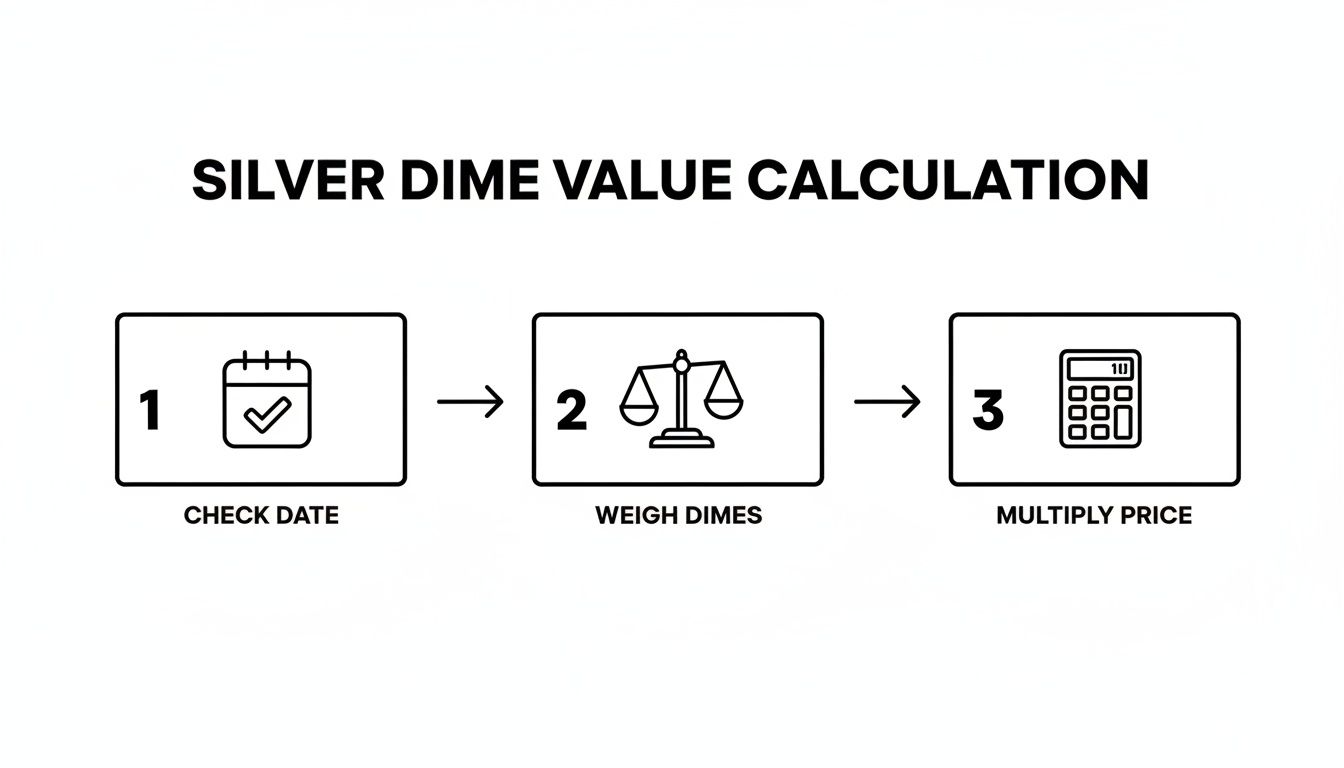

As the graphic shows, checking the date is always where you start, before you ever put your coins on a scale.

Here at our Boise shop, we specialize in gold and jewelry buying, and we always evaluate every single item for both its raw material value and its potential as a collectible. We offer free Xray scanning and gold testing to give you a transparent, hassle-free offer. With our price matching promise, you can save the hassle and sell locally for more than online shipments. We're committed to making sure you get the highest payout in Boise.

Get the Highest Payout for Your Silver in Boise

Once you understand the real value hiding in that old coin jar, the next question is where to turn it into cash. When it's time to sell your silver dimes, jewelry, or gold, choosing the right buyer makes all the difference in what you walk away with.

Mail-in services might sound easy, but they come with headaches you just don't need. You're dealing with the risks of shipping, the potential for insurance nightmares, and the very real possibility of getting a lowball offer from a company you've never met. Why not save the hassle and sell locally for more than online shipments?

The Boise Advantage

Selling your precious metals in person, right here in Boise, puts you in complete control. As specialists in gold and jewelry buying, we’ve built our entire process around transparency and trust. You get a straightforward, hassle-free experience from the moment you walk in.

We invite you to watch every step of the assessment. We use state-of-the-art Xray scanning and gold testing equipment—all for free—so you know the exact composition and worth of what you own. No guesswork, just clear answers.

We are so confident that we offer the highest payout in Boise that we back it up with a price matching guarantee. You can sell knowing you're getting the absolute best price for your items. Period.

Forget about the risks and delays of mailing your valuables to a faceless company. A face-to-face evaluation means you get paid instantly and securely. Our expert team is ready to help you understand your assets and make an informed decision.

Let's Answer Some Common Questions

To wrap things up, let's tackle a few of the most common questions people ask when they're thinking about selling old silver dimes. Getting good, straight answers helps you move forward with confidence, knowing you're making a smart decision.

Are Dimes Made After 1964 Worth Anything?

This is a crucial question, and the answer is pretty simple. Dimes minted from 1965 onward are made of a copper and nickel blend—they contain no silver. They're still worth ten cents, of course, but they don't have any value as a precious metal.

The cutoff is a hard-and-fast rule: only dimes dated 1964 and earlier have the 90% silver that makes them valuable to buyers. This makes spotting the valuable ones in your collection a straightforward process.

Does the Condition of My Silver Dimes Affect the Price?

For the vast majority of common-date silver dimes, their value is tied almost entirely to their silver content. So, for these "junk silver" coins, condition doesn't really move the needle on price.

However, if you happen to have a rare date, a key mint mark, or a coin in pristine, uncirculated shape, its collector (or numismatic) value could be much higher than what the silver is worth.

At our Boise shop, we carefully evaluate every single coin for both its silver content and its potential numismatic value. This ensures we can provide you with the absolute best and highest payout in Boise for what you have.

What if I Have Other Silver Coins or Jewelry?

The same principles that apply to silver dimes also apply to other old U.S. coins. Quarters and half dollars from 1964 and earlier are also made of 90% silver, and we figure out their value the exact same way. The question of "how many silver dimes make an ounce" is really just the beginning.

As experts in gold and jewelry buying, we purchase all forms of precious metals. This includes things like:

- Other 90% silver coins (quarters, half dollars, dollars)

- Gold and silver bullion bars and rounds

- Sterling silver flatware and items

- Gold, silver, and platinum jewelry

You can save the hassle and sell locally for more than online shipments. Bring in everything you have for a comprehensive, hassle-free offer. We provide free Xray scanning and gold testing and stand by our price matching guarantee.

Ready to discover the true value of your coins and jewelry? Visit Carat 24 - Trusted Gold Experts for a professional and transparent evaluation. We offer immediate, no-obligation payouts. Learn more about our services.