Figuring out the value of 5 ounces of silver isn't as simple as checking a single price tag. It’s more like putting together a puzzle. The final picture—the cash in your hand—depends on a few key pieces coming together just right.

Think of the global 'spot price' as the starting point, the raw wholesale cost. But from there, the specific form of your silver (is it a coin or a bar?), its condition, and crucially, where you decide to sell it, all play a huge role in what you actually get paid.

Your Quick Guide to Silver's Value

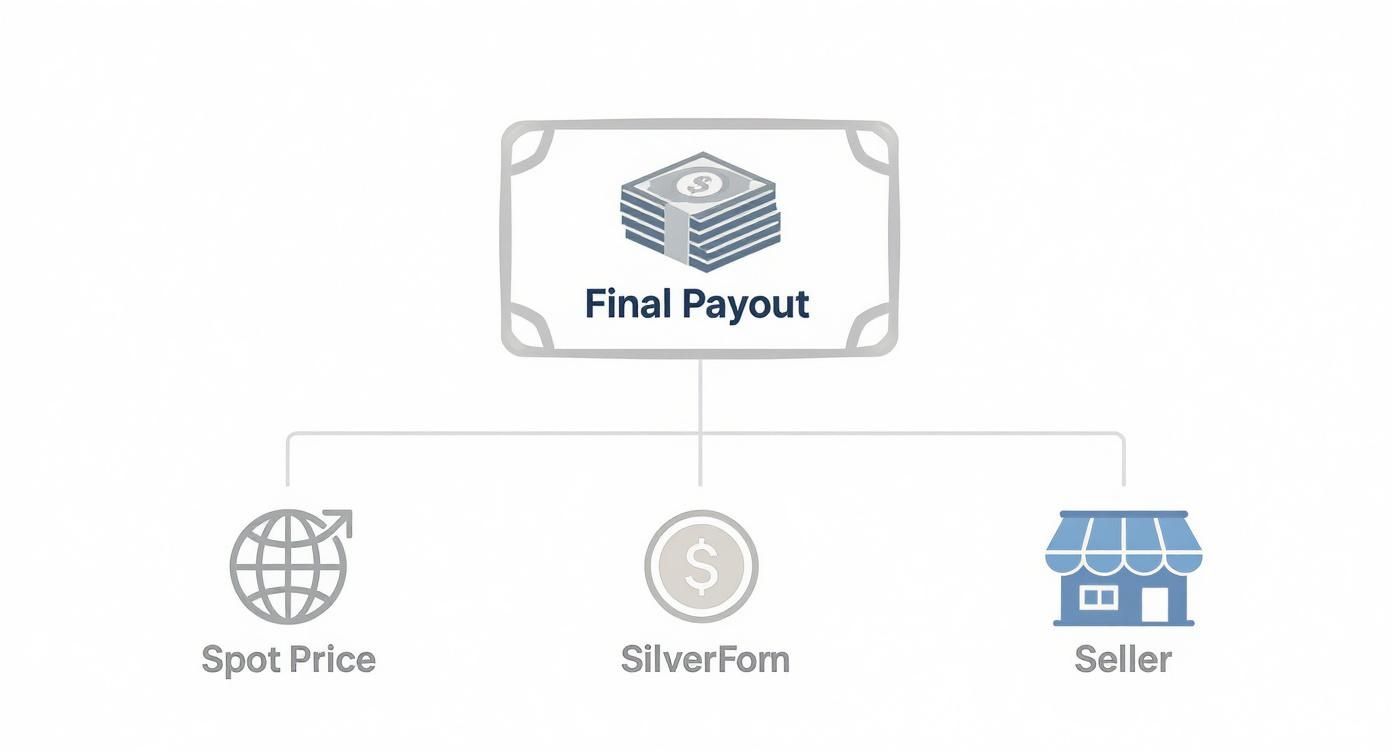

The puzzle for determining your silver's cash value has three main pieces: the daily spot price, the type of silver you own, and the buyer you choose. Each one is a critical step in the calculation. For example, a 5 oz government-minted coin like an American Silver Eagle often fetches a higher price than a generic 5 oz silver bar. Why? Collectibility and the trusted reputation of the mint add value beyond the metal itself.

Getting a firm grasp on this structure is your first step toward getting the most money for your assets. The infographic below lays out exactly how these components build on each other to determine your final payout.

As you can see, it's a hierarchy. Your offer is built on the foundation of the spot price, then adjusted based on what kind of silver you have. The final—and often most overlooked—step is who you sell to. This can make all the difference.

Get the Highest Payout in Boise

Where you sell your silver matters, a lot. Online mail-in services might dangle an attractive initial quote, but that number can shrink fast once you factor in shipping costs, insurance fees, and the long wait for them to process and pay you.

You can save the hassle and sell locally for more than online shipments.

A trusted local expert provides a transparent and immediate transaction. Here’s what you should be looking for:

- Hassle-free offers with zero pressure to sell.

- Free Xray Scanning and Gold Testing to instantly verify purity.

- A Price Matching guarantee to ensure you’re getting the highest payout in Boise.

The table below breaks down the key factors that influence what you’ll ultimately get for your 5 ounces of silver.

| Factor | What It Means for Your Silver | Impact on Value |

|---|---|---|

| Spot Price | The live market price for one troy ounce of raw silver. | Sets the baseline value of the pure silver content in your item. |

| Premiums | The amount you pay over spot price when buying, or get back when selling. | Higher for rare coins, lower for generic bars. This is where you recoup collector value. |

| Buyer's Fees | The percentage or fee the buyer charges to facilitate the transaction. | Directly reduces your final payout. Look for transparent, low fees. |

| Form & Condition | Is it a coin, bar, or round? Is it in mint condition or circulated? | Government coins and pristine items command higher premiums and better offers. |

| Seller Choice | Local coin shop vs. online mail-in vs. pawn shop. | Drastically affects the final offer, speed of payment, and overall experience. |

Understanding these components empowers you to know what your silver is really worth before you walk in the door.

By choosing a local Gold and Jewelry Buying expert in Boise, you gain access to professional tools and transparent pricing. This ensures you’re not just selling your silver—you’re maximizing its true market value with confidence and ease.

How the Silver Spot Price Sets the Foundation

Any conversation about the value of 5 ounces of silver has to start with one thing: the spot price.

Think of it as the wholesale cost—the raw, baseline price for one troy ounce of silver being traded on the big global commodity markets. It’s the number everyone in the industry uses as their starting point.

This price is never still. It’s constantly moving, reacting in real-time to economic news, investor moods, and industrial demand. For instance, a strong jobs report might boost the dollar and cause silver to dip. On the other hand, whispers of inflation could send investors running to the safety of precious metals, pushing the price skyward.

Getting a handle on this volatility is the first step. You can dive deeper into the mechanics of it all in our guide on the spot price for gold and silver.

Market Volatility and Your Silver

The history of silver is a rollercoaster of price swings. Back in 2011, silver rocketed to nearly $50 per ounce. At that peak, 5 ounces would have been worth around $250.

Fast forward just five years to 2016, and the price had tumbled to less than $14 per ounce. Suddenly, those same 5 ounces were worth under $70. This is a perfect example of how much market timing and the broader economic climate can affect what ends up in your pocket.

A trusted local Gold and Jewelry Buying expert stays on top of these market shifts. They provide transparent, hassle-free offers based on the live spot price, ensuring you get the highest payout in Boise without the guesswork.

Turning Spot Price Into a Real Offer

Here's the thing to remember: the spot price is just the beginning of the calculation. No one—whether it’s an online mail-in service or a local shop—is going to pay you the full spot price. They have overhead, staff, and need to make a profit to stay in business.

A reputable buyer, however, will use that live price as the clear foundation for their offer. They won't hide where their numbers come from.

To make sure you're getting the best deal for your silver, you need a buyer who believes in transparency. That means:

- Free Xray Scanning and Gold Testing: This is the professional way to instantly and accurately find out the exact purity of your silver without any damage.

- Price Matching: A confident buyer will be happy to match any legitimate local offer, guaranteeing you the most competitive price.

- No Hidden Fees: You want to avoid the nasty surprises that often pop up with online services, like shipping costs, insurance deductions, and other charges.

By choosing to sell locally, you save the hassle and sell locally for more than online shipments. You get a better price and walk out with immediate payment. It’s that simple.

Why Premiums Can Increase Your Payout

If the spot price is the baseline for your 5 ounces of silver, think of the premium as the extra value stacked on top. This is a concept that plays out all the time in the real world. For instance, a 5 oz American Silver Eagle coin will almost always fetch a higher price than a plain, generic 5 oz silver bar, even though they both contain the exact same amount of pure silver.

That extra value is what we call the premium. It’s the amount someone is willing to pay over the silver’s raw melt value, and it’s driven by factors that have absolutely nothing to do with the daily commodity market.

What Creates a Premium

So where does this extra value come from? Premiums are born from a mix of trust, artistry, and good old-fashioned scarcity. A silver coin from a government body like the U.S. Mint comes with a rock-solid guarantee of its weight and purity, something a private mint might not offer. That recognized brand name alone adds a layer of value.

But it goes deeper than that. Things like the coin's design, its physical condition, and how many were ever made can transform a simple piece of metal into a sought-after collectible. The more desirable an item is, the higher its premium climbs.

Here are the key drivers that build up a premium:

- Mint Recognition: Items from sovereign mints, like the U.S. Mint or the Royal Canadian Mint, carry the most trust. This reputation translates directly into higher premiums.

- Collectibility & Rarity: Limited-run coins, special commemorative designs, or older coins with a bit of history are far more valuable to collectors. You can see how this works in our guide to the value of old silver dollar coins.

- Condition: It’s simple—a pristine, uncirculated coin will always command a much higher price than one that’s been dinged, scratched, or worn down over time.

This is a great opportunity to see how the form of your silver directly impacts its potential payout. A generic bar is valued almost entirely for its metal content, while a collectible coin has multiple layers of value.

Comparing Common 5 oz Silver Forms

| Silver Form | Typical Premium | Key Value Driver |

|---|---|---|

| Generic Silver Bar | Low | Purity and weight (melt value) |

| Sovereign Silver Coin | Medium to High | Government guarantee, design, and collectibility |

| Collectible/Numismatic Coin | High to Very High | Rarity, historical significance, and condition |

Ultimately, a generic bar gives you the spot price, but a coin or collectible piece offers much more upside.

When you sell your silver, you're not just selling the metal; you're also selling its story and pedigree. A local Gold and Jewelry Buying expert in Boise can identify these valuable premiums, ensuring you receive the highest payout possible.

With a hassle-free offer, an expert can assess these nuances right in front of you. Using tools like free Xray Scanning and Gold Testing, they can instantly verify the purity without a single doubt and then properly evaluate its collectible value. When you save the hassle and sell locally, you get paid for both the silver content and its premium—something online mail-in services often overlook.

The Global Forces That Influence Silver Prices

The value of your 5 ounces of silver is tied directly to some powerful global trends. It helps to think of it like a small boat on a big ocean; its movement is dictated by the massive currents of the world economy. Two big forces—industrial demand and investor sentiment—are constantly pulling silver prices in different directions.

On one hand, silver is a workhorse metal, a critical component in all sorts of modern technology. From solar panels and electric vehicles to the electronics in your pocket, its use creates a steady industrial demand. This demand acts as a sort of price floor, giving silver's value a baseline of support. When manufacturing is booming, the need for silver grows, putting natural upward pressure on its price.

Investor Demand and Economic Health

On the other hand, silver is also a "safe-haven" asset, much like its cousin, gold. During times of economic uncertainty, high inflation, or geopolitical tension, investors often rush to precious metals to protect their wealth. This surge in demand can cause prices to spike dramatically as people seek stability outside of traditional stocks and bonds.

To see how these trends have played out over time, take a look at our overview of historical silver prices over the last 100 years.

The strength of the U.S. dollar also plays a crucial role here. Since silver is priced in dollars, a weaker dollar generally makes it cheaper for foreign investors to buy, which often boosts its price.

The value of 5 ounces of silver has swung pretty significantly over the years, perfectly reflecting these global shifts. For instance, a 5-ounce silver bar you could have bought back in 2003 for about $24.25 would have been worth around $102.65 by 2020. That really highlights its potential as a financial hedge.

Understanding these forces helps you see the bigger picture. When you decide to sell your silver, you’re not just trading metal; you're tapping into its dynamic role in the global economy.

Where to Sell for the Highest Payout in Boise

Alright, you've done the homework and understand what goes into the value of 5 ounces of silver. Now for the most important part: turning that silver into cash. You've got options, but they are definitely not all created equal. Picking the right place to sell is the difference between getting top dollar and leaving a chunk of your money on the table.

Many people first look at online mail-in services. They splash some big, attractive numbers on their websites, and it's easy to get drawn in. The problem? Those initial quotes often shrink once all the hidden costs pile up. Suddenly, you're getting hit with shipping fees, mandatory insurance, and "processing charges" that turn that great offer into something pretty disappointing. On top of that, you have to deal with the stress of shipping your valuables and then waiting days—or even weeks—to get paid.

The Local Advantage: Hassle-Free Offers

If you want to get the most for your silver, you need a process that's transparent, fast, and pays you right away. This is where a trusted local Gold and Jewelry Buying expert in Boise really shines. Instead of wrestling with the delays and deductions of sending your silver away, you can get a solid, hassle-free offer on the spot, with absolutely no pressure to sell.

The benefits of selling face-to-face are just common sense. You get to ask questions, see the evaluation for yourself, and walk out with instant payment. This approach completely removes all the guesswork and waiting games. Our guide on how to sell a bar of silver breaks down how to prepare for a smooth, profitable sale.

Selling locally means you’re not just a tracking number in a system. A reputable Boise buyer provides a personalized experience, ensuring you feel confident and informed throughout the entire transaction.

Cutting-Edge Verification and Price Guarantees

A top-tier local buyer won't just guess at your silver's value; they'll use advanced technology to prove it. With free Xray Scanning and Gold Testing, the exact purity of your 5 ounces of silver can be confirmed instantly, without leaving so much as a scratch on your items. This scientific method means your offer is based on hard data, not just an estimate.

Beyond that, a real commitment to offering the highest payout in Boise is often backed up by a Price Matching guarantee. If you bring in a better written offer from another local competitor, a trusted buyer will match it. That promise ensures you never have to wonder if you got the best deal. It’s the ultimate peace of mind.

At the end of the day, you can save the hassle and sell locally for more than online shipments. By dodging hidden fees and leaning on in-person expertise, you lock in a better price and walk away with cash in your hand, often on the very same day.

Common Questions About Selling Silver

If you're thinking about selling your silver, you probably have a few questions rolling around in your head. Getting clear answers is the key to walking into any transaction with confidence and walking out with the best possible price.

One of the first things people ask is, "Will I get the full spot price for my silver?" The honest answer is no. Whether you're dealing with an online buyer or a local shop, every business has overhead. A reputable Gold and Jewelry Buying expert will always use the live spot price as a transparent starting point for their hassle-free offer, but the final number will be just under that.

Maximizing Your Payout by Selling Locally

So, where should you sell? Online dealers can seem tempting, but once you factor in shipping, insurance, and processing fees, that initial offer starts to shrink. You can often save the hassle and sell locally for more than online shipments.

Choosing a local expert here in Boise gives you some major advantages:

- Immediate Verification: Free Xray Scanning and Gold Testing can confirm your silver's exact purity in moments. No waiting, no guessing.

- Guaranteed Best Price: A solid Price Matching promise means you know you're getting the highest payout in Boise.

- Instant Payment: You leave with cash in your hand, skipping the weeks-long delays common with mail-in services.

The most important thing is to find a buyer who operates with total transparency. An honest assessment based on live market data, free testing, and a price-match guarantee are the signs of a trustworthy local dealer you can count on.

Of course, the value of 5 ounces of silver itself is a moving target, heavily influenced by the economy. Global trends recently gave silver a major boost. For instance, if silver hits $47.77 per ounce (as it did in a forecast for October 2025), your 5 ounces would be worth about $238.85. That represents a huge 46.24% jump from the previous year, showing just how strong the market can be. You can track these trends and discover more insights on TradingEconomics.com.

Finally, you might wonder why offers can vary so much from one buyer to the next. As we break down in our guide on how much pawn shops pay for silver, it all comes down to their business model and expertise. A specialized gold and silver buyer simply has the right equipment and deeper market knowledge to make a stronger offer.

At Carat 24 - Trusted Gold Experts, we're committed to providing transparent, top-dollar offers for your silver, gold, and jewelry. Stop by our Boise location for a free, no-obligation evaluation and see for yourself why selling to a trusted local expert makes all the difference. Learn more at https://carat24boise.com.