If you've ever thought about buying or selling gold, you've probably heard the term "spot price." But what exactly is it? Think of the gold spot price as the live, up-to-the-second market rate for one troy ounce of pure gold that's ready for immediate delivery. It's the baseline, the wholesale cost that underpins every gold transaction on the planet, from massive trades between international banks to you selling a bit of old jewelry right here in Boise. Understanding this is key to getting the highest payout in Boise for your valuables.

What Is the Gold Spot Price?

Getting a handle on the gold spot price is the crucial first step to making sure you get a fair deal. This is the raw value of the metal itself, before any other costs—like minting a coin, crafting a piece of jewelry, or a dealer's markup—are factored in.

This price is set by the constant buying and selling on global commodities exchanges. Because it’s a live market, the price you see online right now will almost certainly be different in an hour, or even in a few minutes. It's a real-time reflection of global supply and demand, investor confidence, and the overall health of the world economy.

To give you a clearer picture, here’s a quick breakdown of what makes up the spot price.

Gold Spot Price At a Glance

The table below summarizes the key ideas that define the gold spot price and how they affect your transaction.

| Component | What It Means for You |

|---|---|

| Global Exchanges | The price is set by major markets like London (LBMA) and New York (COMEX). This ensures a universal, standardized starting point. |

| Live Market Price | It's the cost for one troy ounce of 24k gold, updated constantly. This is the baseline from which all offers are calculated. |

| Wholesale Rate | Think of it as the price for raw, unfabricated gold. Retail prices for coins or jewelry will always be higher due to other costs. |

| Benchmark Standard | Every legitimate buyer, from a local shop to a national mint, uses the spot price as the foundation for their pricing. |

Ultimately, the spot price is the anchor for every transaction, providing a transparent and globally recognized standard of value.

Why Spot Price Matters to You

When it comes to Gold and Jewelry Buying or selling, the spot price is your North Star. It's the universal reference point that every reputable buyer uses to calculate what they can offer you. Without it, pricing would be all over the map, leaving you guessing whether you're getting a fair shake.

Here at Carat 24, we base every single valuation on the live spot price. It's a core part of our commitment to transparency. We want our customers in Boise to walk away knowing they received a fair assessment based on what the market is doing right now. An informed seller is an empowered one, and that’s exactly what we aim for.

The spot price serves as the starting point for all gold transactions. Your final payout will depend on your item's purity (karat), weight, and the buyer's margin, but it all begins with this global benchmark.

Local Expertise and Hassle-Free Offers

While the spot price is a global figure, the experience of selling your gold is very much a local one. Choosing a trusted local buyer in Boise means you can skip the headaches and risks that come with online mail-in services. There's no need to package up your valuables, ship them off, and cross your fingers for a check to arrive. You can save the hassle and sell locally for more than online shipments.

We make the process straightforward and personal. When you come to us, you get:

- Free Xray Scanning and Gold Testing: We'll verify the purity and authenticity of your items with you, right there in the shop. No mystery, no guesswork.

- Price Matching: We’re confident in our offers. If you get a better written offer from a competitor, we'll match it.

- Hassle free offers: Our entire goal is to give you the highest payout in Boise with complete clarity and integrity.

How Global Markets Determine the Gold Price

The gold spot price isn't some number pulled out of a hat by a secret committee. Think of it more like a massive, non-stop global auction. It's the dynamic result of countless trades happening every single second, all over the world.

In this auction, the bidders aren't just regular folks. We're talking about major players like central banks, huge investment funds, mining companies, and jewelry manufacturers, all buying and selling gold. Their combined activity, constantly reacting to economic news, currency fluctuations, and world events, is what creates the live price you see on your screen. This ensures the spot price is a genuine, real-time reflection of global supply and demand.

The Epicenters of the Gold Trade: London and New York

While gold trades everywhere, two cities really anchor the global market: London and New York. They are the undisputed heavyweights, and what happens there has the biggest impact on the price.

- London (LBMA): The London Bullion Market Association (LBMA) is the hub for the "over-the-counter" market. This is where massive institutions trade enormous volumes of physical gold directly with each other. They set a key benchmark price twice a day that serves as a reference point for huge contracts worldwide.

- New York (COMEX): Run by the CME Group, the COMEX is the world's primary market for gold futures contracts. These are essentially agreements to buy or sell gold at a set price on a future date. The intense trading of these contracts has a powerful influence on the current spot price.

Because of this global network, the gold market is almost always open. The trading day passes from Asian markets to European and then to American markets in a continuous, 24-hour cycle.

A Global Auction in Action

Let’s make this real. Imagine a major central bank decides to beef up its gold reserves and places a massive buy order. This sudden surge in demand, without an equal increase in available gold, naturally pushes the price higher.

On the flip side, if economic news is fantastic and investors feel confident, they might sell off their gold to jump into the stock market. This flood of supply hits the market and causes the price to drop. Every single trade, from the smallest investor to the largest bank, plays a part in this constant price discovery. That’s why the spot price is always moving—it's like the world's financial heartbeat, reacting instantly to new information.

For anyone looking into Gold and Jewelry Buying, understanding this is crucial because it explains why timing matters so much. You can get a deeper sense of how these forces work by checking out the current gold market prices today.

The spot price is essentially the "bid" price on the global market—the highest price a buyer is willing to pay for an ounce of gold at that exact moment. It's the starting line for every gold transaction.

How a Global Price Hits Home in Boise

So, this huge global price is set in London and New York, but its impact is felt right here in Boise. When you walk into our shop to sell your gold, that international spot price is the foundation for the offer you'll receive.

At Carat 24, we use this live, transparent data to make sure our offers are always fair and up-to-the-minute. We start with free Xray Scanning and Gold Testing to confirm your item's purity. Then, we calculate its value based on its weight and the real-time market price.

This way, you can save the hassle and sell locally for more than online shipments. We turn a complex global number into a simple, straightforward offer, and with our Price Matching guarantee, you know you’re getting the highest payout in Boise.

The Forces That Make Gold Prices Move

The gold spot price doesn't just wander aimlessly; it’s constantly reacting to a handful of powerful global economic forces. Think of it like a finely tuned instrument, responding to every little shift in the financial world. If you’re considering selling your gold here in Boise, understanding these drivers gives you crucial context for why the price you see today is what it is.

These forces create a constant push and pull, making gold more or less attractive to everyone from big-shot investors and central banks to everyday jewelry buyers. That dynamic is exactly what causes the price to tick up and down all day long.

Inflation: The Value Protector

One of the biggest players on the field is inflation. When the purchasing power of a currency like the U.S. dollar gets weaker, everything costs more. In times like these, investors flock to gold because it has a long, proven history of holding its value against inflation.

Simply put, as your dollars buy less, gold often buys more, making it a reliable place to park your wealth. This surge in demand acts as a tailwind, pushing the spot price higher. For a deeper dive, you can explore our guide on what affects gold prices.

Interest Rates: A Balancing Act

Interest rates and gold are locked in a constant balancing act. When interest rates are high, investments like bonds or even a simple savings account offer a decent return, or "yield." Since a bar of gold just sits there and pays no interest, it starts to look less appealing by comparison. As a result, its price can dip while investors chase those easy yields.

On the flip side, when interest rates fall, the opportunity cost of holding gold shrinks. Suddenly, the precious metal looks like a much more attractive option, which often sends the spot price climbing.

Gold often thrives in low-interest-rate environments. When other assets aren't paying much, the security and stability of gold become far more appealing to investors.

Geopolitical Uncertainty: The Safe Haven

There's a good reason gold has earned its reputation as a 'safe-haven' asset. During times of global instability—think wars, messy trade disputes, or political crises—investors tend to get nervous. They often pull their money out of riskier assets like stocks and run toward the perceived safety of gold.

This "flight to safety" creates a huge spike in demand, which in turn drives the price up. You can almost always see a ripple in the gold market after a major global event, as people scramble to protect their wealth from uncertainty.

Gold's spot price today reflects one of the most explosive bull runs in modern history, capping off a 65% gain in 2025 alone—the strongest annual performance in over four decades. This surge wasn't random; it was fueled by sweeping U.S. tariffs shaking global trade, expectations of lower borrowing costs from the Fed, endless geopolitical headaches, relentless central bank purchases, and massive inflows into gold ETFs as investors fled volatility. You can discover more insights about these historic gold trends on TradingEconomics.com.

From Spot Price to Your Actual Payout

Okay, so you know what the gold spot price is. That’s the first step. But the real question is, how does that number translate into actual cash in your hand?

This is where a lot of first-time sellers get a little confused. It’s a common surprise to learn that no buyer—whether it's us or someone else—pays 100% of the spot price for scrap or used jewelry. The reason is simple: spot price is the benchmark for pure, 24-karat gold bullion. Most of the jewelry sitting in your drawer isn't pure gold; it's a gold alloy.

An offer from a buyer is all about bridging the gap between that theoretical market price and the real-world value of your specific item. It all boils down to two things: your item's actual gold content and the buyer’s margin.

Melt Value and Buyer's Margin

The melt value is the number that truly matters. It's the raw value of the pure gold hiding inside your jewelry. Since most pieces aren't 24k, their value is directly tied to the percentage of gold they contain.

Take a typical 14k gold necklace, for instance. By definition, it's 58.3% pure gold. To get its melt value, you'd take its total weight, multiply it by 58.3%, and then multiply that result by the current spot price. Easy enough.

From there, a buyer applies their margin, sometimes called a spread. This is a percentage deducted from the melt value to cover the real costs of doing business—things like refining the gold back to its pure form, running the shop, and earning a profit. Any transparent, reputable buyer will walk you through this so you know exactly how they arrived at their offer.

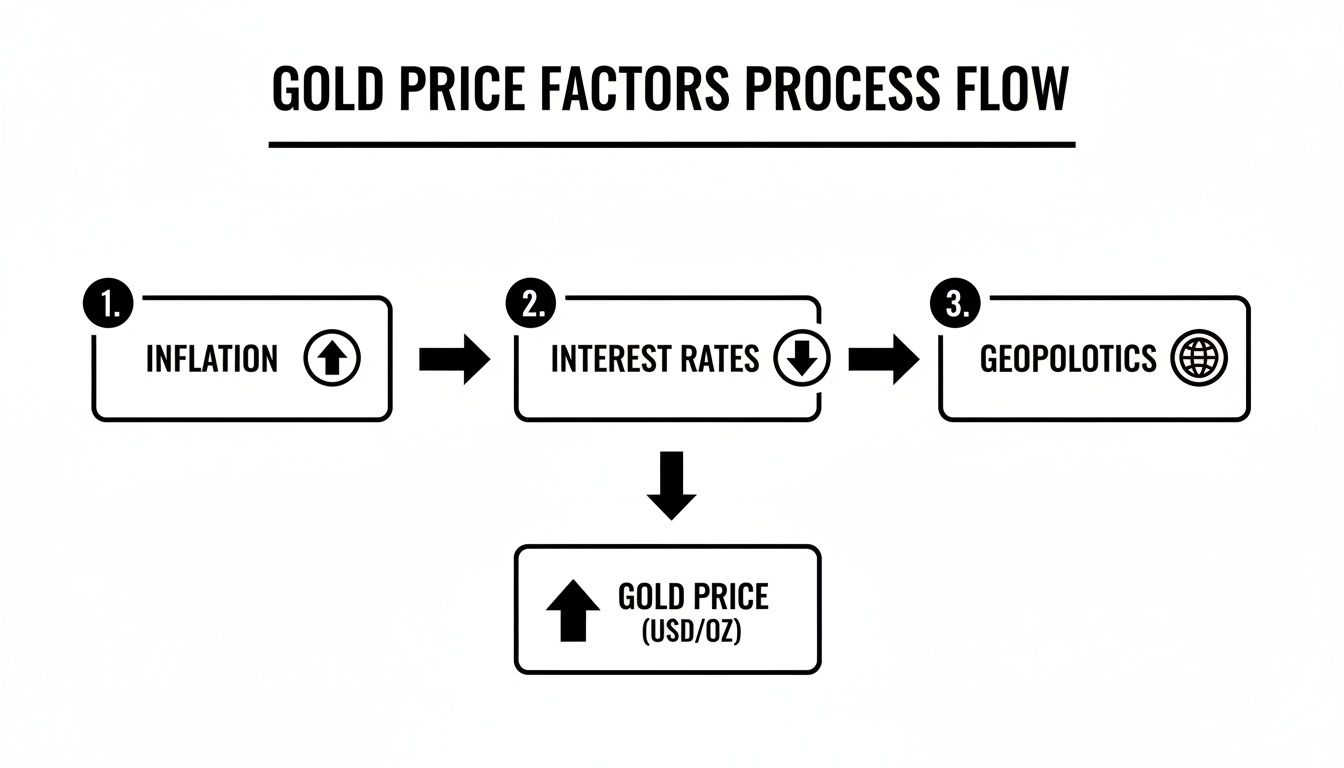

This flow chart gives you a peek behind the curtain at the big-picture economic forces that move the spot price up and down every single day.

As you can see, things like inflation, interest rates, and global events are constantly pushing and pulling on the foundational price used in all these calculations.

Spot Price vs Your Payout What's the Difference?

To make it crystal clear, let's break down the key terms that bridge the gap between the price you see online and the offer you receive in person.

| Term | Definition | Impact on Your Payout |

|---|---|---|

| Spot Price | The live market price for one troy ounce of pure, 24k gold traded on major exchanges. | This is the starting point for all calculations, but it's not the final offer price. |

| Melt Value | The total value of the actual pure gold in your item, based on its weight and purity (e.g., 14k). | This is the true market value of your item's gold content before any fees or margins. |

| Buyer's Margin | The percentage a buyer deducts from the melt value to cover refining, overhead, and profit. | This directly reduces the final offer. Reputable buyers have fair, transparent margins. |

| Final Payout | The cash offer you receive. It's the melt value minus the buyer's margin. | This is the actual amount of money you walk away with. |

Understanding these distinctions is the key to feeling confident and empowered when you sell your gold. You're not just accepting a number; you're verifying a fair process.

Calculating Your Payout A Simple Example

Let's run through a quick, transparent example to see how it all works in practice.

Imagine you bring in a 14k gold chain that weighs 20 grams, and the gold spot price is sitting at a nice, round $75 per gram.

-

Calculate Pure Gold Weight: First, we figure out how much of that 20-gram chain is actually gold.

- 20 grams (total weight) x 0.583 (the purity of 14k gold) = 11.66 grams of pure gold.

-

Determine Melt Value: Now, we find the market value of that pure gold.

- 11.66 grams x $75 per gram (spot price) = $874.50. This is your chain's melt value.

-

The Final Offer: A buyer will then make an offer based on a percentage of that melt value. A fair, competitive offer might be in the 80-90% range.

- $874.50 (melt value) x 85% = $743.33 cash in your pocket.

A transparent buyer breaks down this math for you. The goal is to demystify the process, so you leave feeling confident you received a fair and honest price based on real-time data.

At Carat 24, we believe this process should be simple and clear. Our hassle free offers are always based on live market prices. We do all the Xray Scanning and Gold Testing for free, right in front of you, so you can see exactly what you have.

With our Price Matching guarantee, you’re assured the highest payout in Boise. You can save the hassle and sell locally for more than online shipments, turning those unwanted items into immediate cash. Knowing how these calculations work is the best way to understand exactly what your gold is worth.

Why Selling Gold Locally in Boise Is a Smarter Choice

So, you understand how the gold spot price works. Now comes the big question: where should you actually sell your items?

It's tempting to consider those online mail-in services you see advertised. They seem convenient, right? But the reality is often a cocktail of risk, delays, and hidden fees that chip away at your final payout. You’re asked to package your valuables, send them off into the unknown, and just… wait. You’re left hoping for a fair shake from a faceless company hundreds of miles away.

There’s a much better way. Choosing a local expert here in Boise offers a far more secure, transparent, and profitable experience. When you sell locally, you completely sidestep the risks and uncertainty of shipping. There's no nail-biting wait for a check to arrive; instead, you get paid on the spot and receive genuine, face-to-face service.

The Power of a Face-to-Face Transaction

The single biggest advantage of selling in person is transparency. You’re right there, part of the process from start to finish. Nothing happens behind a curtain.

That’s exactly how we operate at Carat 24. We offer a completely open and honest experience, starting with free Xray Scanning and Gold Testing performed right in front of you. This isn't some backroom magic; it's state-of-the-art technology confirming the exact purity of your gold, silver, or platinum. No guesswork, no "let me take this in the back."

From that scientific analysis, we make hassle free offers. And because we’re so confident in our pricing, we also offer Price Matching, guaranteeing you receive the highest payout in Boise. Our whole approach is built to let you save the hassle and sell locally for more than online shipments. Our Gold and Jewelry Buying process is designed to be easy and rewarding.

Choosing a local buyer means you get instant verification, a clear explanation of your offer, and immediate payment. You maintain control over your valuables throughout the entire process.

Seizing the Moment with Local Expertise

When it comes to precious metals, timing is everything. For our neighbors in Boise, whether you're handling an estate, hunting for treasures, or you’re a woman in her 60s or 70s looking to cash in on heirloom jewelry, Rolex watches, or Louis Vuitton bags, the time is now.

Here at Carat 24, located at 3780 W. State St., our experts are ready to guide you. We combine an understanding of global price peaks, which you can track on sites like TradingEconomics.com, with personalized, local service. We help turn family legacies into smart financial moves.

Our team doesn't just know the global markets; we know the Boise community. By partnering with a trusted local expert, you gain an advocate who is dedicated to getting you the best possible price. For more tips on finding the right buyer, be sure to check out our guide on the best place to sell gold.

How to Get the Highest Payout at Carat 24

Alright, you've got a handle on what the gold spot price is and how it’s set. Now for the important part: turning that knowledge into the most cash possible when you bring your items to us at Carat 24. We've built our entire business around being completely transparent and accurate, so you can feel confident you’re getting the best offer in town.

It all starts with our thorough, 8-step authentication process. This isn't just a quick glance—it's a careful, methodical evaluation to pinpoint the exact value of your gold and jewelry. From gold bars to grandma's intricate necklace, we assess every piece with precision. This meticulous approach is how we can consistently offer the highest payout in Boise.

Preparing for a Successful Visit

A little bit of prep work on your end can make your visit incredibly smooth and profitable. Before you head over to our shop at 3780 W. State St., we suggest a couple of simple steps to put you in the driver's seat.

First, take a quick second to check the live gold spot price online. This gives you a real-time baseline and lets you know what the market is doing that day. Next, gather up any paperwork you might have for your items, like original receipts or certificates of authenticity. Sometimes, this can add to the value.

Our whole goal is to create a welcoming, no-pressure environment. We do all the Xray Scanning and Gold Testing for free, right there in front of you, explaining what we're doing so you're never left wondering.

This open book process takes all the mystery out of Gold and Jewelry Buying. Plus, our Price Matching promise means you never have to wonder if you could have gotten a better deal somewhere else.

For anyone in Boise thinking about selling gold jewelry or bullion, watching the market highlights just how much timing can matter. As you can see from historical trends explained in this JM Bullion investing guide, prices can swing quite a bit. Our 8-step authentication ensures that no matter when you come in, you're getting top dollar for your genuine pieces.

We really encourage you to stop by and see the difference for yourself. You can save the hassle and sell locally for more than online shipments—no shipping risks, no waiting for a check, just a fair and immediate payment.

Got Questions About Selling Gold? We’ve Got Answers.

Let's wrap things up by tackling a few of the most common questions we hear from folks walking into our Boise shop. Getting clear on these points can make all the difference when you decide to sell.

Is the Gold Spot Price the Same Everywhere?

Yes, in a sense. The spot price is a global benchmark, a universal number quoted in U.S. dollars that traders all over the world look at.

But here's the nuance: that price will look different in another country once you factor in currency exchange rates. More importantly for you, the final offer you get for your gold jewelry isn't just the spot price. It's a calculation based on your item's actual purity (the karat), its weight, and the small margin the buyer needs to operate their business.

How Often Does the Gold Spot Price Change?

Constantly. Think of it like the stock market—it’s always in motion, updating every few seconds while the markets are open. This live fluctuation is why we use the real-time price at Carat 24. It ensures the offer we make you is perfectly fair and accurate for that exact moment.

It’s crucial to remember the spot price you see online is for pure, 24k gold bullion. The value of your 14k gold ring, for example, is based on its 58.3% gold content. Buyers also have real-world costs like refining and business operations, which are built into the final offer.

Our whole approach is built on transparent, hassle free offers and giving you the highest payout in Boise. That's exactly why we provide free Xray Scanning and Gold Testing right in front of you. With our Price Matching guarantee, you can save the hassle and sell locally for more than online shipments. Our professional Gold and Jewelry Buying services are designed for your convenience and benefit.

Ready to see what your gold is really worth?

Stop by Carat 24 - Trusted Gold Experts at 3780 W. State St. in Boise. We’ll give you a free, no-pressure evaluation and you can walk out with the best offer today.

Find out more on our website: https://carat24boise.com.